In today’s financial world, investing has become not just a way to grow your capital but also a necessary part of your personal financial security.

However, one of the most essential principles of successful investing is diversification, which means spreading money across different assets to reduce risk. Whether you are a beginner or an experienced investor, the ability to create a balanced, diversified portfolio is the key to long-term investment growth.

What is diversification, and why is it important?

Diversification is a strategy of spreading investment funds across different assets, industries, regions, or even currencies to minimize potential losses. The main idea is that not all assets behave the same way in various economic conditions.

When stocks fall, bonds may remain stable; when the economy grows, real estate and stocks may rise; and gold may act as a “haven” during crises.

In other words, diversification is a way to avoid putting all eggs in one basket.

The main advantages of diversification:

risk reduction: losses in one area can be offset by gains in another.

more stable returns: the portfolio is less sensitive to short-term market fluctuations.

psychological comfort: investors do not panic over temporary declines in individual assets.

flexibility: the ability to adapt the strategy to the economic situation.

Main asset classes in a diversified portfolio

For a portfolio to be truly balanced, it is essential to understand what it comprises. Below are the main asset classes commonly used for diversification.

Stocks

Stocks are shares in a company. They can provide high returns, but they also entail greater risk.

Investors often choose:

Large-cap stocks - stable, but with moderate growth;

Mid/small-cap stocks - riskier, but potentially more profitable;

Sector diversification - investing in different sectors (technology, energy, healthcare, etc.)

Bonds

Bonds are debt instruments that generate a fixed income. They help reduce a portfolio's overall volatility.

Main types:

Government bonds - the most reliable, but with lower yields;

Corporate bonds - slightly riskier, but with higher rates.

Cash and short-term instruments

Funds held in deposits or cash funds provide liquidity and stability. They do not generate high returns, but they allow you to respond quickly to market changes.

Real estate

Investing in real estate can provide stable rental income and long-term asset growth. Today, many investors prefer REITs (Real Estate Investment Trusts)—a way to invest in real estate without physically owning the properties.

Commodities

These include gold, silver, oil, etc. They are often used as a hedge against inflation or financial market instability.

Alternative investments

These include cryptocurrencies, venture capital, private funds, or even art. They can be highly profitable, but should only be considered as a small part of your portfolio (5-10%).

Steps to create a diversified investment portfolio

Step 1: Define your goals

Start with the question: Why are you investing?

It could be saving for retirement, buying a home, your children’s education, or simply protecting your capital from inflation. Your goals will determine your investment term (short, medium, or long), the level of risk, and the desired return.

Step 2: Assess the level of risk you are willing to accept

There are three main types of investors:

Conservative - prefers stability (60-80% bonds, the rest - stocks)

Moderate - willing to take some risk (50% stocks, 40% bonds, 10% alternatives)

Aggressive - focused on growth (70-90% stocks, all others - bonds)

Step 3: Select assets and priorities

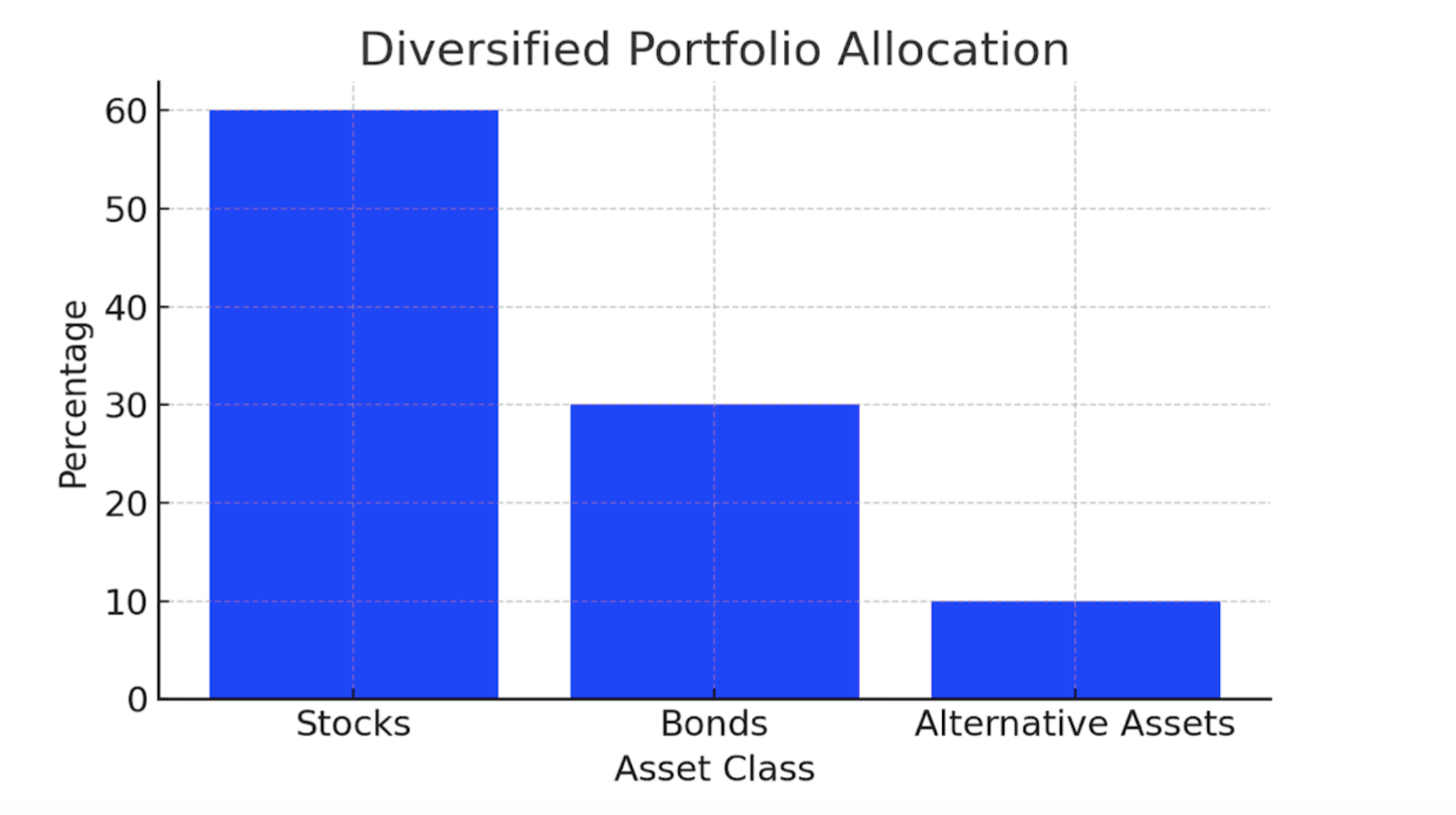

A typical diversified portfolio might look like this:

Of course, this is only a guideline—the exact proportions depend on your personal goal and the market situation.

Step 4: Distribute investments within each class

Diversification works not only between asset classes, but also within each class. For example:

for stocks: different sectors (technology, energy, consumer goods) and regions (US, Europe, Asia).

for bonds: different issuers (government, corporate) and maturities.

for real estate: residential, commercial, international.

Step 5: Use investment funds

If you are unable to purchase dozens of assets on your own, the following are exact solutions:

ETFs (exchange-traded funds) - allow you to invest in a broad market, such as the S&P500;

Mutual funds - professionally managed portfolios;

Step 6: Rebalance regularly

The market is constantly changing: stocks may grow faster than bonds, disrupting your initial balance.

Rebalancing is the process of returning your portfolio to its original proportions, for example, once a year. This helps control risk and lock in profits.

Common mistakes

When building an investment portfolio, many people fall into similar traps that can significantly affect long-term results. Understanding these mistakes helps you avoid them and create a more resilient strategy.

Overconcentration in a single asset.

Putting too much money into one stock, sector, or asset class exposes you to unnecessary risk. For example, if the majority of your portfolio is invested in technology companies, your results will largely depend on the performance of that single sector. If it experiences a downturn, your entire portfolio may suffer.

A well-balanced portfolio should spread risk across different sectors, industries, and asset types to reduce vulnerability.

Ignoring currency fluctuation risk.

Investing internationally can be a smart way to diversify, but it also introduces exposure to foreign exchange movements. Even if the investment itself performs well, unfavorable changes in the value of the U.S. dollar (or another relevant currency) can reduce your gains—or amplify your losses.

Understanding FX risk and how it influences your returns is crucial, especially for long-term global investors.

Lack of rebalancing

Markets constantly shift, and over time, your portfolio may drift away from your original allocation. For example, if stocks grow faster than bonds, your portfolio may unintentionally become much more aggressive.

Regular rebalancing—monthly, quarterly, or yearly—helps ensure your investments remain aligned with your goals, risk tolerance, and investment horizon.

Panic selling during market downturns

One of the most damaging mistakes is reacting emotionally to market volatility. Short-term declines are a regular part of investing, yet many people sell during a downturn to “protect” themselves—often locking in losses right before the market eventually recovers. Successful investors stay disciplined, stick to their plan, and view downturns as temporary, not catastrophic.

Invest without clear goals

Having no specific objectives makes it difficult to choose appropriate investment products or strategies. Are you saving for retirement, a home, education, or financial independence? Each goal may require a different time horizon, risk level, and asset mix. Clear goals act as a roadmap, helping you make coherent, consistent investment decisions instead of reacting randomly to market trends or emotions.

Examples of diversified portfolios

Conservative portfolio

20% stocks (ETFs on large companies)

60% bonds (government and corporate)

10% gold or other commodities

10% cash/short-term deposits

Moderate portfolio

50% stocks (30% US, 20% international)

30% bonds

10% real estate (through REITs)

10% alternative assets

Aggressive portfolio

70–80% stocks (including emerging markets)

10–20% bonds

5–10% alternative investments or cryptocurrencies

How to maintain your portfolio in the long term

Building a portfolio is only the first step — maintaining it properly is what determines your long-term success. A well-managed portfolio adapts to your changing goals, market conditions, and personal circumstances. Here are key principles to help you stay on track.

Keep track of your investments.

Regular monitoring allows you to understand how your portfolio behaves over time.

You can use spreadsheets, mobile apps, or dedicated portfolio-tracking platforms to follow your returns, check whether your asset allocation remains balanced, and identify potential sources of risk.

Tracking doesn’t mean checking every day — but staying aware of overall trends helps you make informed decisions rather than acting impulsively.

Review your portfolio once a year.

A yearly review is a good moment to re-evaluate your goals, time horizon, and risk tolerance.

Did your income change? Are you planning a big purchase? Are you closer to retirement?

During this review, adjust your asset allocation if necessary. This is also the ideal time to rebalance your portfolio to keep it aligned with your plan, rather than drifting toward excessive risk or conservatism.

Keep an eye on costs.

Investment costs add up, and even small fees can significantly reduce long-term returns. Brokerage fees, fund management costs, and transaction expenses can quietly erode your profits.

Being mindful of costs is one of the simplest and most effective ways to boost long-term performance.

Keep learning.

Financial markets evolve, new products appear, and strategies continue to develop.

Staying curious and educating yourself helps you better understand your investments and avoid common mistakes.

Read books, follow credible financial sources, take courses, or listen to investment podcasts.

Over time, this knowledge builds confidence and makes you a more disciplined and thoughtful investor.

Conclusion

Diversification is not just financial advice; it is the foundation of smart investing. It helps reduce risk, preserve capital, and ensure long-term stable growth.

Creating a diversified investment portfolio requires planning, discipline, and regular analysis. However, the reward is confidence in the future, regardless of what happens in the markets.

Remember: investing is a marathon, not a sprint. Start small, spread your risks, and your capital will work for you even while you sleep.