REIT

A REIT is a company or fund that owns, manages, or finances income-producing real estate. By investing in a REIT, you are essentially buying a share of a large real estate portfolio.

How does it work?

You buy a REIT share just like you would buy a regular stock on the stock market. The fund generates income from renting, selling, and managing real estate. Most REITs are required to pay at least 90% of their profits to investors in the form of dividends.

Advantages:

High dividends. REITs are known for their stable payouts

Liquidity. You can sell shares on the stock exchange at any time.

Accessibility. The initial investment can be as low as $100.

Diversification. A single REIT can own hundreds of properties in different countries.

Disadvantages:

Taxation of dividends.

Stock price fluctuations, as with ordinary securities.

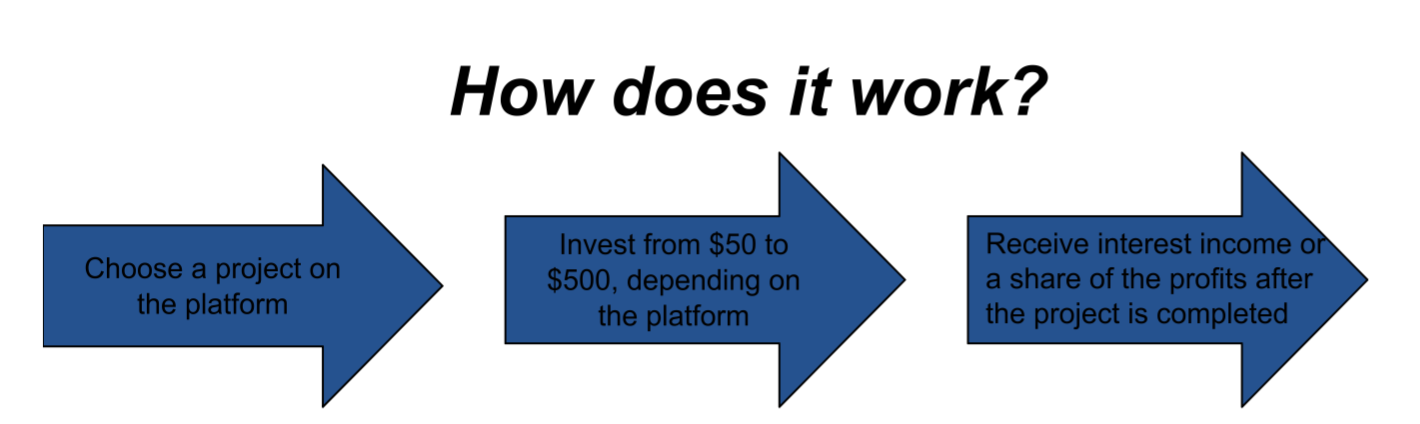

Real Estate Crowdfunding

These are platforms that allow many investors to jointly finance real estate projects. You invest a certain amount, and it is used to build or purchase real estate.

Advantages:

Affordable entry threshold.

Real, transparent projects.

Average annual return: 8–15%.

Disadvantages:

Investments are less liquid — it is difficult to exit before maturity.

Dependence on the professionalism of the developer.

Popular global platforms:

Fundrise

RealtyMogul

CrowdStreet

For Ukrainian investors, access may depend on payment systems and regional restrictions.

Investing in real estate through ETFs

ETFs (exchange-traded funds) are portfolios of assets that can be traded on the stock exchange like stocks. There are ETFs, that focus entirely on real estate or specific segments of it.

Advantages of real estate ETFs:

Low fees.

Industry-wide diversification.

Easy to purchase

Popular ETFs:

VNQ (Vanguard Real Estate ETF) — one of the largest funds in the world.

SCHH (Schwab U.S. REIT ETF) — with low fees.

REET (iShares Global REIT ETF) — global real estate.

Private Equity Real Estate Funds

These are closed-end funds that pool investors' capital to purchase or manage large real estate properties such as office centers, retail spaces, and hotels.

Advantages:

High potential returns.

Professional management.

Disadvantages:

The entry threshold is often $10,000 or more.

Money is locked up for 3–7 years.

Risks associated with the management company.

This instrument is more suitable for experienced investors.

Virtual real estate investments (metaverse)

There is a new trend for modern investors — buying “land” in metaverses such as Decentraland or Sandbox. This is digital real estate that has value in the form of NFTs and demand depends on the popularity of the platform.

Advantages:

Innovative.

Potentially high returns.

Accessibility.

Disadvantages:

High volatility.

Risks associated with the NFT market.

Speculative nature.

This is an option for those who understand the risks of cryptocurrencies and are willing to experiment.

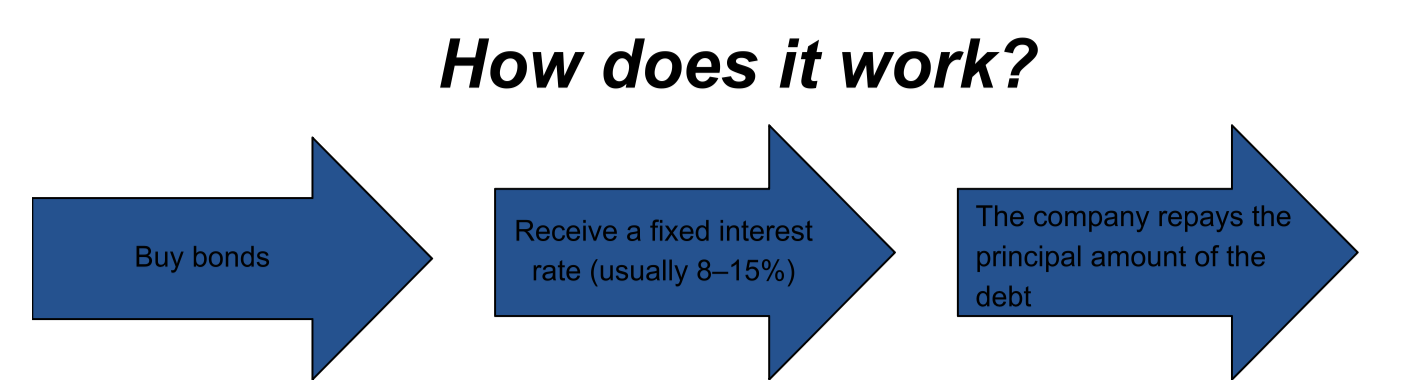

Bonds secured by real estate

These are debt instruments issued by developers, builders, or companies operating in the real estate sector.

Advantages:

A simpler mechanism than funds.

Fixed income.

Disadvantages:

Risk of company default.

Dependence on the real estate market.

Similar instruments also exist in Ukraine, but it is always important to check the issuer's reputation.

Investing through construction cooperatives and share programs

In some countries, such programs allow you to invest in construction without purchasing a specific apartment. You invest in the project and receive a share of the profits when construction is complete.

Advantages:

Low entry threshold.

Transparency in joint cooperatives.

Disadvantages:

Legal risks.

Dependence on the developer.

Conclusion

Investing in real estate without physically purchasing it opens up access to one of the most stable markets, even for people with small budgets. Modern instruments — REITs, ETFs, crowdfunding platforms, developer bonds, and private funds — allow investors to choose the level of risk, liquidity, and method of participation without being tied to a specific property. This provides flexibility, saves time, and eliminates the stress associated with repairs or finding tenants.

The right combination of these tools will help create a balanced portfolio that will generate stable passive income while protecting capital from inflation. You can start with very small amounts — the main thing is to be consistent, understand your goals, and think long-term. In today's world, investing in real estate without buying a property is not just an alternative, but one of the most affordable and flexible ways to grow your finances.