Approximately $11.9 million would be the final result of a trader who opened an account with a $10,000 deposit in early 2010 and followed a simple trading strategy for 10 years, according to a study by mathematicians from the University of Linz. Doesn't it seem so simple?

More realistically speaking, the potential profit directly depends on the trader. An intraday trader can earn more than a hundred percent of his deposit per month by taking high risks and spending a significant amount of time on preparation and trading. A passive investor, spending a minimum of time and minimizing risks, hopes to earn a moderate annual percentage that will protect savings from the effects of inflation.

As you can see, the answer depends on various factors, without which the answer will be a meaningless number. So, let's unlock the mystery of mysterious stock market returns. In this article, we will take into account the pitfalls of this question and together we will formulate a qualitative answer. And as a bonus, we'll talk about the key principles of success in the stock market business.

Why can you make money on the stock exchange?

Behind the scenes of market growth

First of all, it is necessary to understand why it is possible to make money on the stock exchange in the first place. Where do investors and traders get the money to make money on the stock exchange, and how much is there? Why hasn't everyone who can draw beautiful lines on three monitors and reads Reddit faster than anyone else earned a million or two dollars?

To answer this, we need to understand the basic purpose of stock exchanges. Historically, they have performed the following critical functions:

Providing shareholders with a centralized and liquid platform for the safe and quick purchase and sale of shares;

Easy attraction of investments by companies and distribution of risks among business owners;

Expanding the range of potential investors - anyone with an open account with a broker can buy shares on the stock exchange;

Monitoring: The exchange provides constant supervision and analysis of listed companies, which increases investor confidence and security.

As you can see, the functions of exchanges do not include “printing and distributing money” or something like that. The main task of an exchange is to reliably and comfortably redistribute funds among trading participants. This means that your earnings are someone else's trading risks.

Let's look at a simple example: Let's imagine a small stock exchange operating in a closed system. You have decided to buy shares of a promising company, in your opinion. In the platform, you placed an order to buy 100 shares at $10.

Another trader has decided that the stock price will fall and wants to open a short position. He saw your buy order at $10 in the platform and accepted it, selling 100 shares to you. From now on, each of you has an open position in different directions, worth $1,000.

A few days later, the company publishes a positive report, and the share price rises to $12. You now have an unrealized profit of +$200. Another trader has a loss of the same amount -$200. At the same time, you can fix your profit at any time, regardless of the trader. Because there are other participants on the exchange to whom you can sell shares at the market price and make a profit.

That is, the money did not appear out of nowhere - you received it from another participant (or participants) in the auction who came to the wrong conclusion. Thus, we have an intermediate answer - potentially, you can earn as much money on the stock exchange as other bidders risk.

How do 90% of traders see the cause of their losses?

How much money is on the stock exchanges?

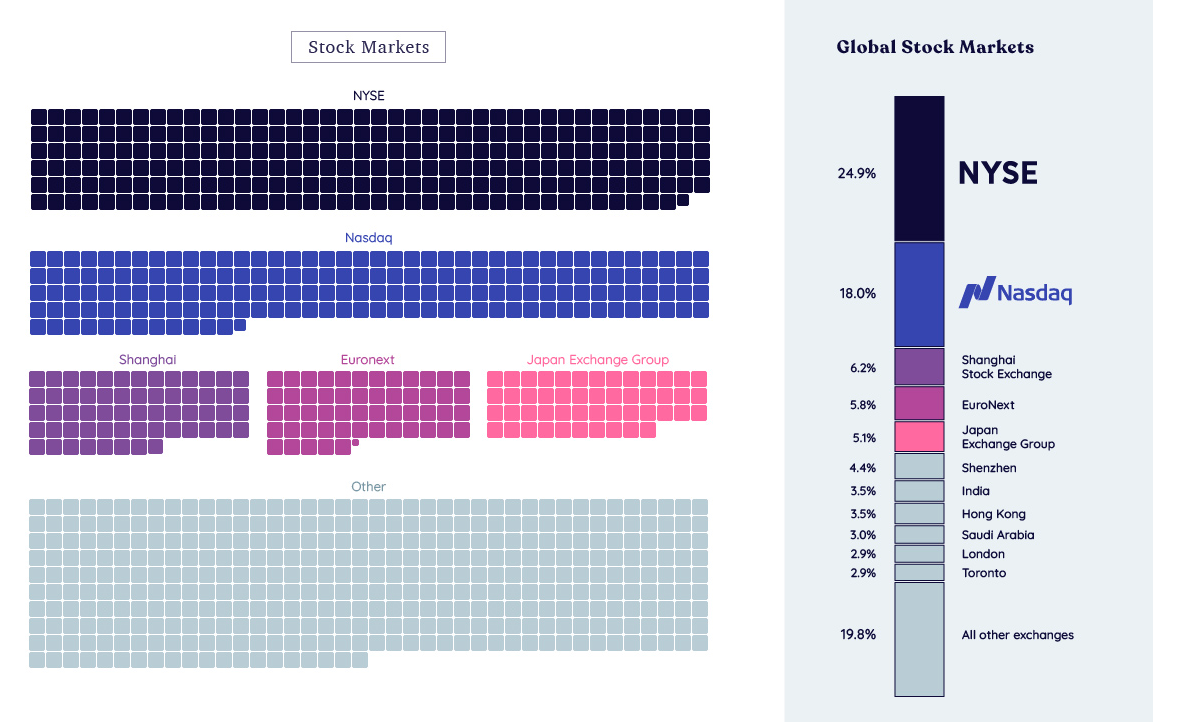

How much money is there on the world's stock exchanges? On the website www.visualcapitalist.com, you can clearly see this fantastic figure as of 2022 - more than $95 trillion.

Visualization of the amount of capital traded on the world's stock exchanges. One square is the equivalent of USD 100 billion. (c) www.visualcapitalist.com

It is a clear fact that most of the market share is not held by active traders. According to Goldman Sachs, in the US in 2020, the market share of institutional players was about 50% - these are mutual and pension funds, ETFs, hedge funds, etc. If we add foreign institutions to this share, it turns out that the vast majority of the market is big capital, which is managed by experts in the interests of fund investors. And the primary goal of such institutions is not to lose investors' funds, because they are very responsible for them.

Therefore, your primary goal should also be not to lose your own funds. This is the goal set by professional companies with many years of experience in the market, and it is the same goal you should set for yourself at the beginning. This is what will directly affect your ability to make money in the market.

What do you need for this? The key factors for this will be systematic work, as well as a balanced attitude to trading and following your own strategy. We will definitely talk about this later in the article.

What affects the amount of income?

Let's return to the main factors that directly affect the profitability of a bidder:

1. Capital size

The first and very important aspect. Unfortunately, the toxic marketing of various scam projects has given rise to the idea that you can earn steadily on the stock exchange with a minimum investment. This is further reinforced by occasional success stories - you probably often see success stories on social media where a “trader” earns incredible amounts of money almost from scratch. But all these stories are typical survivor bias. For every such story, there are several times more failures (which, of course, no one will talk about).

The essence of modern marketing in trading

In fact, the amount of your capital has a direct impact on the amount of income. As paradoxical as it may sound, the larger your capital is, the greater your chances of not losing money and earning money systematically.

First of all, bigger capital allows you to control your risks more effectively. The larger your account reserves are, the smaller percentage of your total deposit you can invest in a single trade or asset. This helps to reduce the impact of losing a single trade on your total capital and preserve the opportunity for future earnings.

Besides, trading is not a free activity. You will always be obliged to pay a trading commission to the broker, as well as a fee for trading software (in the format of a monthly fee or larger trading commissions). If you start with a small amount, the infrastructure will “eat” almost all of your profits. In turn, a larger capital will help you make more voluminous trades, which in absolute terms lead to higher potential profits. This will help cover the cost of trading and work in the black.

Fondexx specialists are well aware of the pressure that broker commissions put on traders. That is why we offer a number of tariff scales (based on the needs of traders, trading activity, software used, etc.) that will be as comfortable as possible for both traders and investors.

2. The logic of the trading strategy

You can trade according to anything: the lunar calendar, the weather forecast, a coin flip. All of this will have some result, sometimes even a positive one.

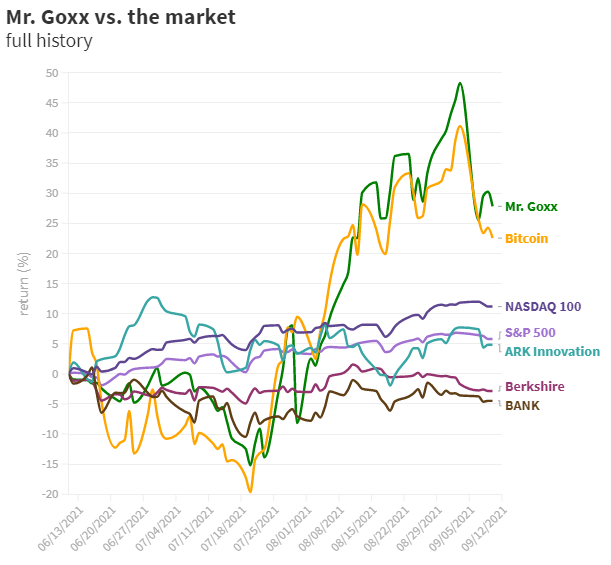

Thus, the hamster trader Mr. Gox managed to add 30% to the value of his portfolio in three months in 2021. With this result, he outperformed the Katie Wood and Warren Buffett funds, the S&P 500 and NASDAQ 100 indices, and even the rapidly growing Bitcoin rate at the time.

Mr. Hawkes yield curve and market benchmarks. (c) www.protos.com

Of course, it's unlikely that the hamster was possessed by the spirit of Jesse Livermore, and the animal was just lucky enough to perform the right actions at the right time. This kind of profit is not systematic, and in the long run, such trading is unprofitable. If Mr. Hawkes had continued his activities (unfortunately, the trader later ended his career), he would have had no mathematical chance of long-term success.

A really working trading strategy should be based on a certain concept that will increase the probability of receiving funds from other market participants. Such concepts are called “market inefficiencies” and can arise in different areas - legal market rules, technical features of exchanges and trading software, interrelationships between different types of stocks, etc. Traders' trading in Fondexx prop and fund is based exclusively on such principles, and all the company's training courses are based on the same principles.

Fondexx training courses. Each course is a well-founded and logical trading strategy

In addition to identifying the source of funds, you need to rationally build a plan for obtaining them. A clear plan of action and its unscrupulous adherence is an essential component of the strategy. The combination of these two points brings the maximum effect, and most importantly, with reasonable efficiency. Otherwise, a trader is no better than Mr. Hawkes - he can count on occasional success at most, with no prospect of making a stable long-term profit. Obviously, this approach is no better than a casino.

3. Frequency and length of trades

This point is directly related to the trading strategy and the amount of capital. The larger the capital of the fund or investor, the slower and longer the trades will be, and, accordingly, the lower the percentage of growth to the deposit. This is due to the fact that the slower and longer the trades are, the fewer market movements can be used to make money.

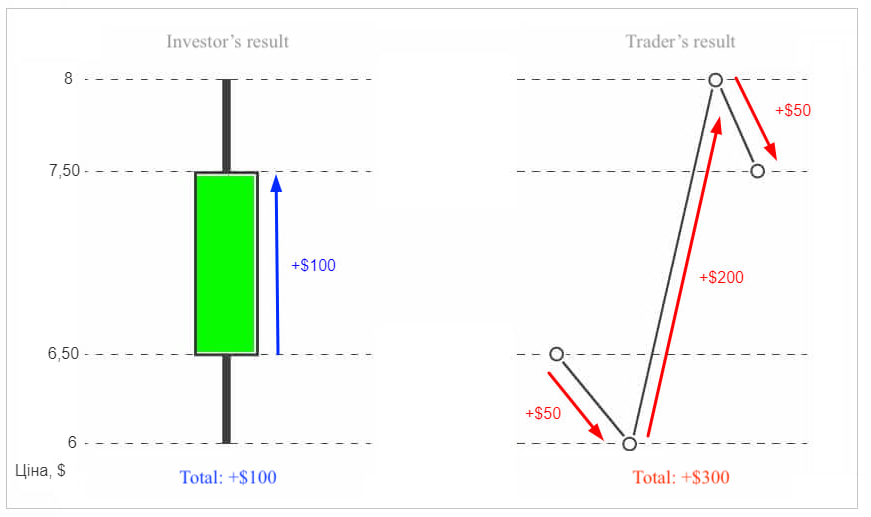

Let's look at an example: an investor holds an open long position on 100 shares of ABC. During the day, the stock rose from $6.50 to $7.50, bringing the investor $100 in profit for the day.

However, if we consider the price movement within the day, the price first dropped to $6, then rose to $8, and by the end of the day fell to $7.50. An active trader who had the opportunity to open several positions during the day on the same 100 shares could have earned three times* more in total by opening two short positions and one long position in between.

* excluding broker's commission.

Of course, trading commissions should also be taken into account, and it is not always possible to open a trade at the most favorable price, but the point remains the same: a skilled active trader earns much more than a passive investor.

An example of an investor and a trader's trade

Fondexx specializes in intraday trading, combining the three aspects of a trading account - financial, technical, and legal - into an ideal environment for active trading.

4. Trading conditions and software

Trading can be very clearly compared to running a business. A company can use a modern and high-quality infrastructure, optimize its costs, use various sales channels, employ modern technologies, and so on. The analogy is as clear as possible: you have competitors - other bidders - and depending on your attitude to this activity, you will have a better chance of success.

For example, you can choose the most expensive tariff, the best platform, buy five monitors, and all this in order to make one small trade per month. Or vice versa: you are going to engage in active trading using a sophisticated strategy, while trading from a web-based platform on your phone via the mobile Internet. The rationality of both approaches is highly questionable - will the first trader recoup his investment, and will the second be able to effectively execute his strategy?

Therefore, be sure to pay attention to the conditions and opportunities offered by your broker and trading platform. We have described in detail what to look for in our article “How to choose the best trading platform for active trading?”. The basics are:

The amount of trading commission and the cost of the platform;

Broker's terms and conditions: maximum trading leverage, % payout, deposit and withdrawal fees, etc.;

Basic platform functionality: available order types, access to the pre/post market, the ability to trade short;

Connection stability and order execution speed;

Special functionality of the trading platform.

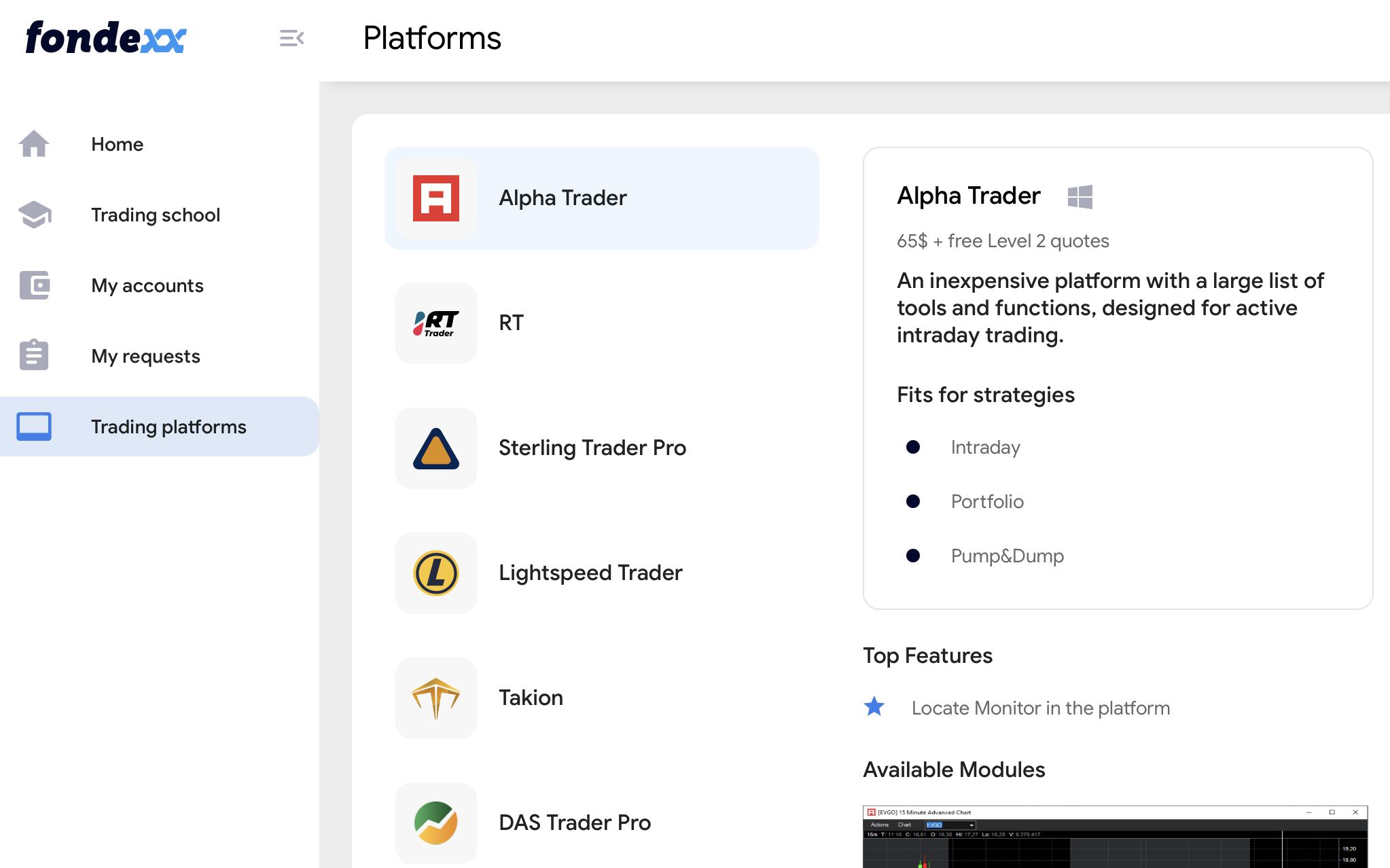

Fondexx offers 6 desktop trading platforms, each of which has its own special features and trading conditions. You can familiarize yourself with them in your personal account or by consulting your manager. But what is unchanged for all platforms is a professional approach to this business and full access to the market.

Trading platforms from Fondexx. Each platform has its own unique features and conditions

Who earns how much on the stock exchange?

Knowing why and how the possibility of earning money on the stock exchange arises, we can now fully answer the main question - how much does a trading participant earn? This is how we will rephrase the question, knowing that different participants claim completely different levels of income - both relatively (in %) and absolutely (in $).

To answer this question, we will distinguish 3 categories of market participants: retail traders, long-term investors, and active investment funds (hedge funds).

How much does a retail trader earn?

Of all these categories, the average retail trader has the least capital at work. As a rule, the capital of an active trader ranges from several hundred dollars to several tens of thousands of dollars (if an account is opened directly with a broker, then to execute trades within a day, you need to have at least $25,000). Neo-brokers and proprietary trading platforms (including Fondexx) provide an opportunity to bypass this rule and open a trading account with less than a thousand dollars.

Due to the small capital and active use of leverage, retail traders have the opportunity to trade a wide range of trading strategies, quickly open and close positions. This makes it possible to use the maximum movements in the market, and accordingly - to receive the maximum increase in the percentage of the deposit.

Throughout 2023, Fondexx is running the Trader of the Month campaign, publishing the results of the most profitable trader for the month, quarter, and year. Traders can also share their comments on their own success, so these results are as revealing as possible in this regard. The results are published monthly in the Fondexx Trader's Chat.

As you can see, the results of the best traders range from several tens to hundreds of percent of the monthly deposit growth. At the same time, the deposit is mostly several thousand dollars.

Of course, these results are the result of hard and systematic work and were achieved by professionals. However, even for them, these figures are not stable - in some months, a trader can earn 100% of the deposit, sometimes it will be 10%, and in bad months, it can even be a minus. The only thing that will distinguish a systematic trader from a ludomaniac in this case is that in the case of a systematic trader, it will be a predictable result within the framework of a strategy that fits into his risk model.

Therefore, if you see expressions like “A trader gets at least 20% per month” or “Our strategies guarantee you hundreds of percent profit”, but there is no mention of risks, this is a common manipulation of your FOMO (fear of missed opportunities).

How much does a passive investor earn?

In the classical sense, a passive investor in the stock market is a person or family that periodically sets aside part of their income by buying low-risk assets with relatively stable returns. Such portfolios are very rarely rebalanced or not reviewed at all.

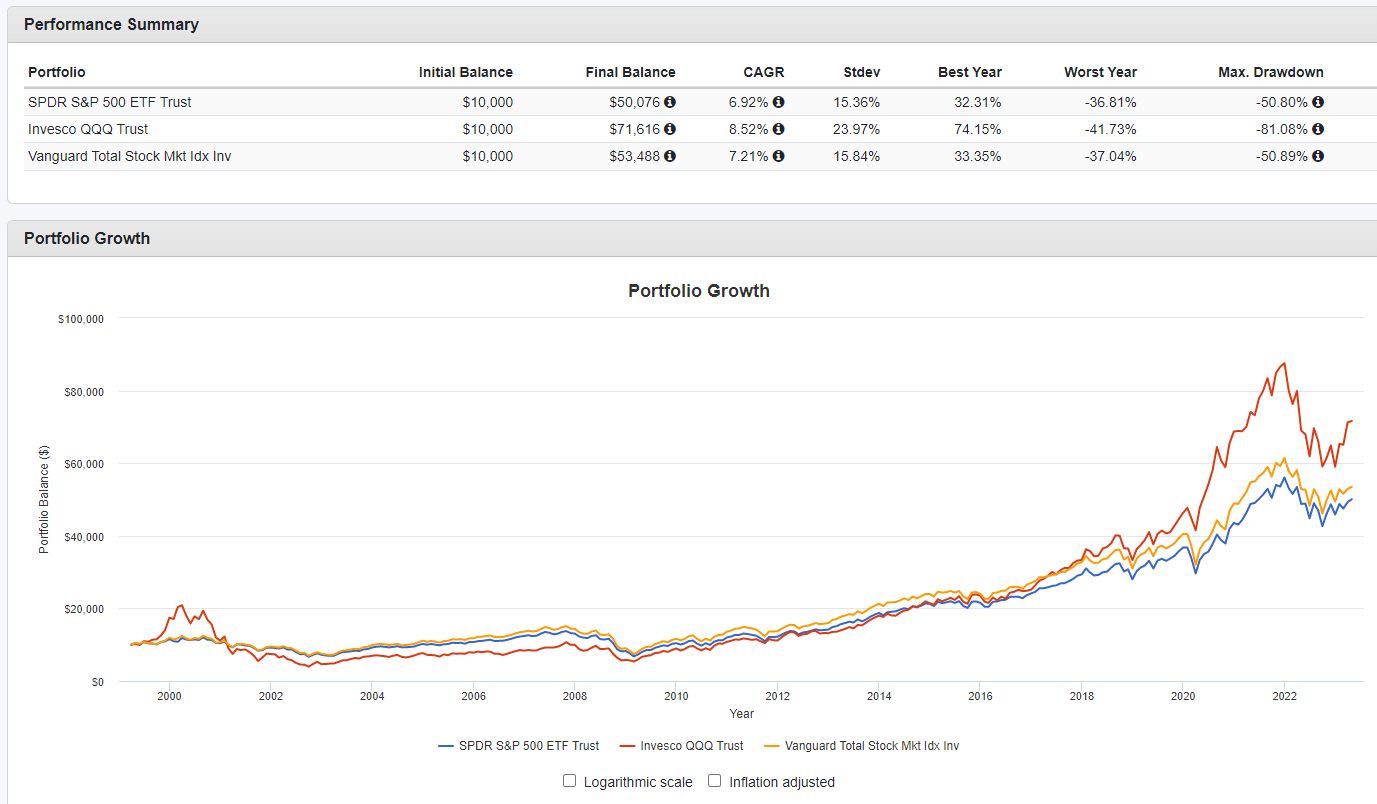

First of all, we are talking about investments in ETFs - funds whose shares are publicly traded on the stock exchange. Typically, ETFs that track stock indices (such as SPY or QQQ) or those that track part or all of the market (such as VTI) are considered for long-term investment.

SPY, QQQ and VTI performance from 1999 to 2023 (c) www.portfoliovisualizer.com

Of course, the results will be much lower than those of retail traders. On average, the market grows by up to 10% per year. The main advantage of long-term investment is the periodic recapitalization of investments and the effect of compound interest. And if the investor additionally diversifies investments with more profitable assets (for example, shares of individual companies or other ETFs), the “passive” interest can reach much higher values. Accordingly, with much higher risks :)

How much does an active investment fund earn?

All investment funds belong to institutional players - companies that manage the capital of their investor clients. Their goal is to outperform market growth while exposing their clients to the lowest possible risk. The basis of their earnings is the commission they receive from them. So let's look at these funds from the investor's point of view - how much can be earned by providing the fund with funds for management.

Active funds (also called hedge funds) usually have much less capital under management than passive investment funds. Therefore, they have the opportunity to use more active strategies - just like retail traders - compared to passive investors.

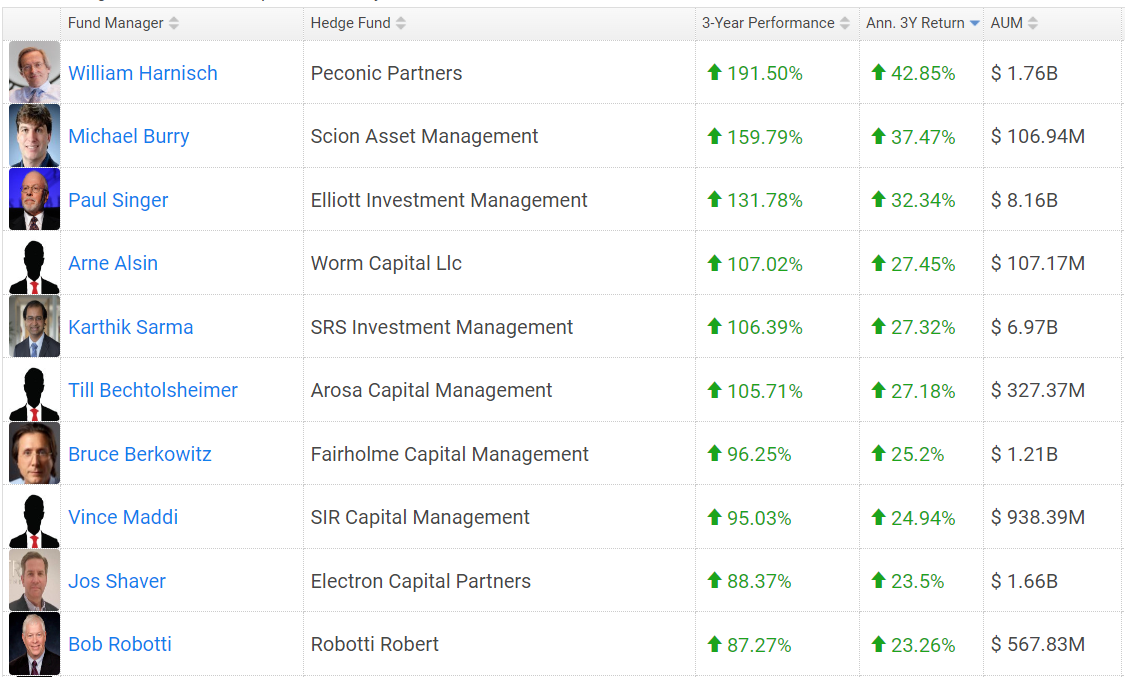

Most hedge funds accept funds from investors with a minimum investment period. Usually, this period is from one year. So let's take a look at the top results of hedge funds in terms of average annual growth over the past 3 years:

Top 10 hedge funds by average annualized return over the past 3 years. (c) www.hedgefollow.com

Most successful hedge funds significantly outperform the market, which is what attracts riskier investors. However, cooperation with a fund is much riskier than simple market investing, as they use active risk strategies, downside play, and leverage in their work. Therefore, hedge funds sometimes offer the opportunity to separate the risk capital of an investment, which the investor is guaranteed to receive back, regardless of the fund's performance.

Fondexx also has its own hedge fund, FNDX Systematic, which generates profits through active trading. In its first public year, the Fondexx fund brought investors +156% on risk capital, significantly outperforming its competitors. You can learn more about the fund's results from the manager during a free consultation.

As you can see, depending on the type of participant, the expected returns vary greatly. Active traders aim to increase their trading capital several times in a month, bearing high risks. At the same time, passive investors dream of adding at least a few percent per annum on top of the market. Each type has its own characteristics that suit different goals and risks. But what is most important is that no one can ever tell you exactly how much money the market will bring you. It will all depend on your level of preparation, action plan, and the logic of your activities.

The basics of trading success

Now you know why, how, and how much real participants in stock trading earn. This knowledge will help you form a clearer picture of this type of activity and focus on specific things in this area.

As promised, in the end, we will describe the basic principles that will be useful for building a systematic and balanced trading. If you are just starting out on your own path as a trader, then be sure to pay attention to these points:

1. Try to soberly assess your situation. If you are just starting to trade, you will not earn millions in the first days, and you need to build up a minimal preparatory base. Exaggerated expectations are very detrimental to a trader and often lead to a fiasco.

2. Don't trade with your last funds. Especially if it is an attempt to make a living, cover debts, etc. You should trade exclusively with your free funds, having other stable sources of income at the initial stages. The best option is to trade on an account with a prop company, a company that provides traders with capital for management. Fondexx is one such company.

3. Develop a clear and reasonable trading strategy. Your strategy should be based on a certain market inefficiency, have a clear algorithm for stock selection, position entry/exit, calculated risk and money management. Be sure to test it before starting to work with real funds - on a demo account or on historical data (backtest).

4. Automate routine processes. Take care of your comfort, both physical and mental. You don't have to create an entire trading algorithm - even automating the selection of stocks for the day will make your trading more comfortable and efficient.

5. Find a comfortable community of like-minded people. Being in a group with other traders, your development will not stop even if you already have a working trading strategy - you will always have the opportunity to consult and advise others, learn something new for yourself. It is important that the community is suitable for you, specializes in the same market, and is minimally toxic and informative. By the way, Fondexx also has a traders' chat on Telegram - you can join it by following this link.

Following these rules will not make you a successful trader overnight, nor will they guarantee quick and easy profits. However, they will definitely increase your chances of success and help you become more disciplined and systematic in your trading.

And you can always start trading with us - after a quick registration on the site.