What is Long-Short Equity Investing?

Long-short equity investing combines two investment approaches:

Long Positions: Investors purchase stocks they believe are undervalued or have growth potential, anticipating that their value will increase over time. Profits are made by selling these stocks at higher prices.

Example: Buying stocks with strong financials or those that pay dividends, which can generate both price appreciation and regular income.

Short Positions: Investors borrow and sell stocks expected to decline in value, planning to repurchase them later at a lower price. The difference between the selling and repurchase price becomes the profit.

Example: Shorting overvalued stocks or those in industries facing downturns.

By combining these positions in a single portfolio, investors aim to minimize the influence of overall market movements and focus on the performance of individual stocks. This strategy aims to achieve positive returns regardless of market direction by offsetting risks between the two positions. Originating in the early 20th century with the rise of hedge funds, it gained prominence in the 1970s and 1980s as statistical models and computing power enhanced its effectiveness. Today, it remains a cornerstone for hedge funds and mutual funds, offering adaptability to diverse market conditions.

Advantages and Disadvantages

Advantages:

Market Independence: Generates returns in both upward and downward market trends.

Hedging: Offsets potential losses from long positions with gains from short positions.

Diversification: Allows exposure to various sectors and industries, spreading risk.

Disadvantages:

Complexity: Requires extensive analysis and expertise to execute effectively.

High Risk: Leverage and short selling can amplify losses.

Implementation Challenges: Involves significant research to identify suitable stocks.

How Does Long-Short Equity Work?

The mechanics of long-short equity investing involve several steps:

Research and Analysis:

Identify undervalued stocks for long positions and overvalued ones for short positions using financial metrics, industry trends, and economic forecasts.

Consider macroeconomic factors such as inflation, interest rates, and sector performance.

Portfolio Construction:

Combine long positions, which profit from price increases, with short positions, which gain from price decreases.

Diversify across sectors, geographies, or industries to reduce correlation with broader markets.

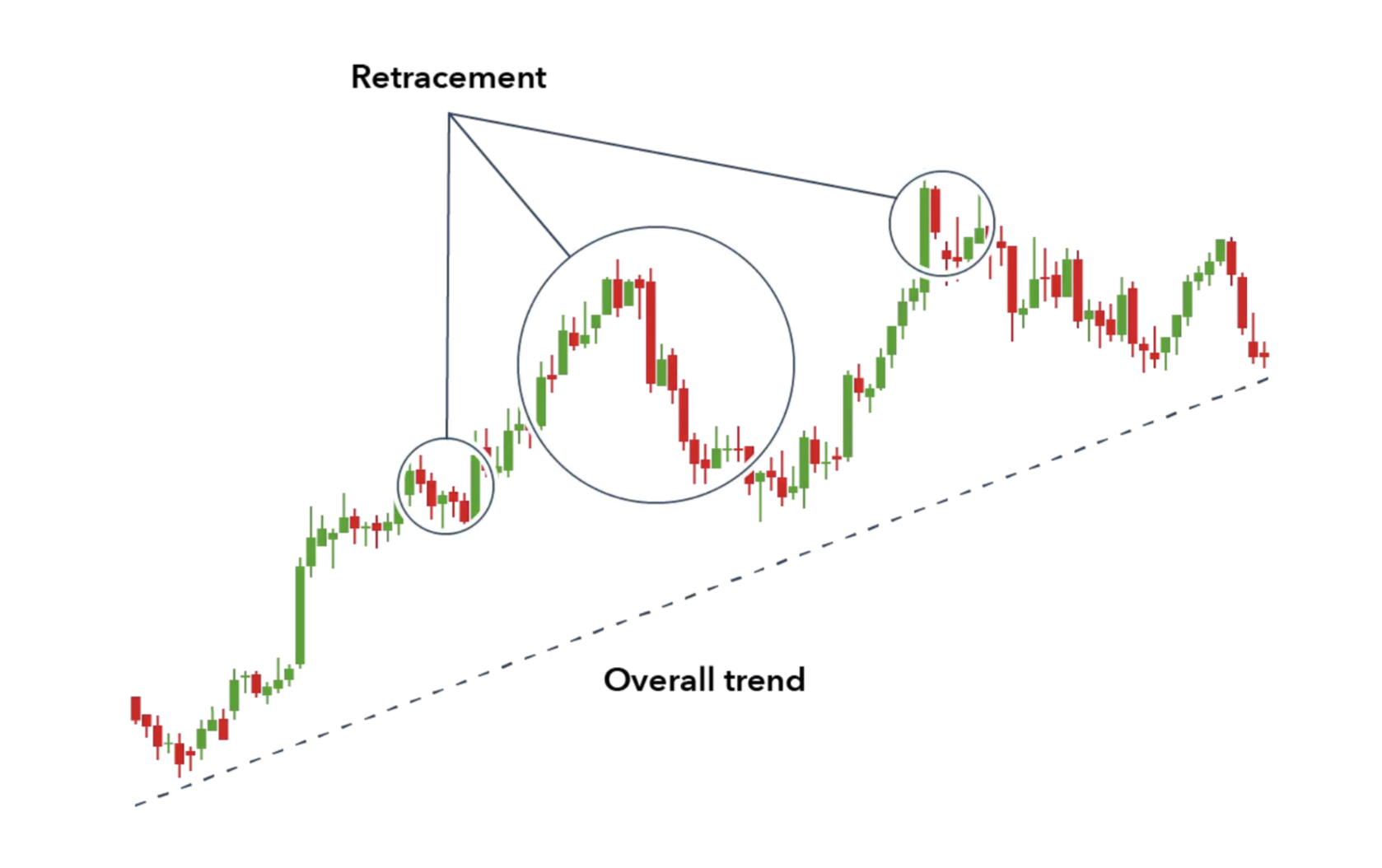

Monitoring and Adjustments:

Continuously track performance, rebalance based on market changes, and refine holdings to optimize risk and return.

Closing Positions:

Sell long positions when targets are met.

Repurchase short positions at lower prices to close the trade.

Example: Applying a Long-Short Strategy

Consider two fictional companies:

Company X: Strong financials and industry trends suggest appreciation.

Company Y: High debt and market challenges predict depreciation.

Steps:

Buy 1,000 shares of Company X at $50/share ($50,000 investment).

Short sell 500 shares of Company Y at $30/share ($15,000 short).

Outcome:

Company X’s price rises to $60, yielding a $10,000 profit.

Company Y’s price drops to $25, resulting in a $5,000 profit.

Net Profit: $15,000.

Types of Long-Short Equity Strategies

Market-Neutral Strategies:

Balance long and short positions to achieve near-zero net exposure.

Focus on stock-specific performance (e.g., pair trading) rather than market trends.

Directional Strategies:

Adjust the ratio of long and short positions based on market outlook.

Favor long positions in bullish markets and short positions in bearish ones.

Sector-Specific Strategies:

Target industries like healthcare or technology, leveraging specialized knowledge.

Combine long positions in outperforming sectors with short positions in underperforming ones.

Geographic Strategies:

Focus on regional trends, such as emerging markets or advanced economies.

Use macroeconomic analysis to anticipate economic changes and guide positions.

Pair Trading:

Long one stock and short another in the same sector to profit from price convergence.

An example might involve going long on Microsoft and short on Intel within the tech sector.

Benefits of Long-Short Equity

Risk Mitigation: Balances gains and losses through offsetting long and short positions, at the same time reduces sensitivity to market fluctuations, particularly during downturns.

Portfolio Diversification: Combines assets expected to outperform and underperform, lowering overall volatility.

Potential for Higher Returns: Profits from both upward and downward market movements.

Flexibility: Adaptable to various market conditions and investment goals.

Challenges of Long-Short Equity

Market Dependency: Success relies heavily on accurate stock selection and timing.

Short-Sale Risks: Potential for unlimited losses if shorted stocks rise significantly.

Higher Costs: Complex strategies incur higher expenses for trading, research, and management.

Execution Complexity: Requires expertise and robust data analysis for optimal results.

Performance Metrics for Long-Short Equity Funds

Performance metrics are crucial for understanding your professional success rate. To begin, check Alpha and Beta. Alpha measures excess return over a benchmark, reflecting stock-picking success.

Beta reflects sensitivity to market movements; long-short strategies aim for reduced beta. You can find more information here. Another friend of your trading strategy is Volatility, use it to understand assesses return stability; lower volatility signals reduced risk.

Other metrics would be:

Sharpe Ratio: Evaluates risk-adjusted returns; higher ratios indicate better performance.

Tracking Error: Measures deviations from a benchmark, indicating active management.

Drawdown: Monitors losses from peak to trough, helping evaluate risk resilience.

Regulatory Considerations

Short-Selling Restrictions: Compliance with market-specific rules to prevent manipulation.

Transparency and Reporting: Funds must adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) standards.

Insider Trading Laws: Strict adherence to prevent conflicts of interest.

Source: www.ig.com

Conclusion

Long-short equity funds offer a flexible strategy for navigating diverse market conditions by balancing market exposure with skill-based alpha generation. Their ability to mitigate drawdowns while capturing opportunities in both rising and falling markets makes them a valuable tool for portfolio diversification. However, investors must consider the inherent risks, costs, and reliance on market conditions when incorporating these strategies into their portfolios. When executed effectively, long-short equity funds can deliver consistent and resilient performance in volatile market environments.