We have compiled a selection of the 11 best websites that we use ourselves and teach TradingSchool students to use. Using these websites, you can quickly get all the information you need when day trading stocks. Here are the best scanners and filters, specialized sites for IPOs, biotechs and SPACs, news resources and sites with trading ideas.

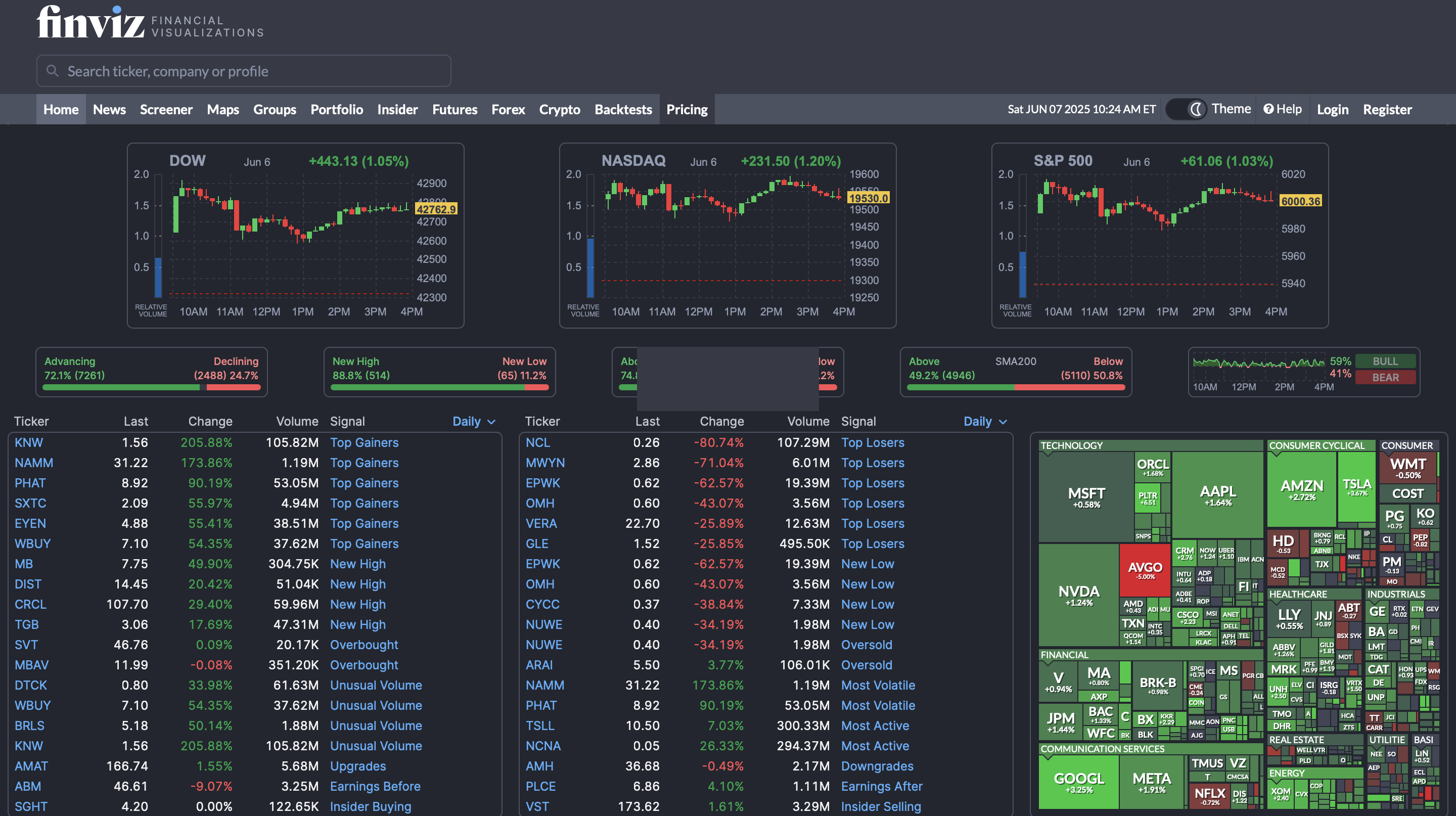

1. Finviz — screener, filter, fundamental indicators of companies, general mood and market condition.

Probably the most famous information aggregator, filter/screener of stocks on the US stock market. This resource has almost all the information, except for the most highly specialized.

Here you can:

Select stocks for trading — the site has a convenient scanner with which you can filter stocks by fundamental, technical and many other parameters, which will suit almost any trading strategy;

Quickly see the most active stocks — top gainers/losers, new high/low, unusual volume, earnings before/after;

Quickly get a general idea of what is happening on the market now.

Much of the functionality on the site is available for free, the rest — for a paid subscription (from $25 per month). When training at Fondexx, access to Finviz Elite is provided free of charge.

You can read more about working with the Finviz service in our free 6-part mini-course.

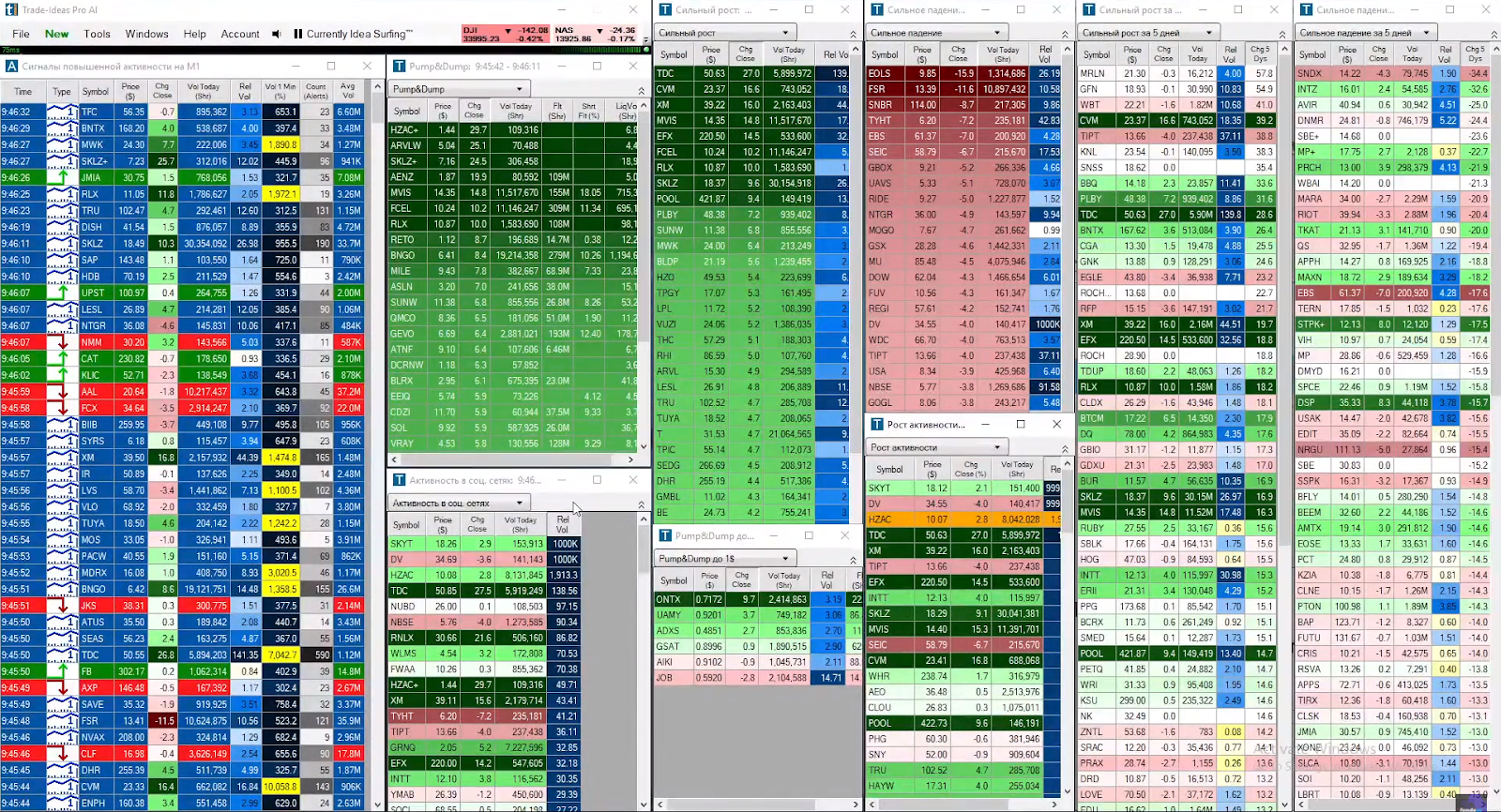

2. Tradeideas is a stock screener for professionals.

This is another US stock market scanner, but much more advanced. The platform works on the basis of artificial intelligence. With its help, you can qualitatively automate the process of selecting and analyzing stocks. Tradeideas can filter stocks by many specified parameters, forming highly specialized watchlists for various strategies, as well as generate trading signals in real time. Another feature of Tradeideas is a stock activity scanner on social networks.

Since August 2020, broadcasts with Trade Ideas signals have been launched daily on the Fondexx YouTube channel. We have configured the scanners in such a way as to cover most of the market activity and save traders time on searching and analyzing assets. This allows you to free up more time for executing transactions.

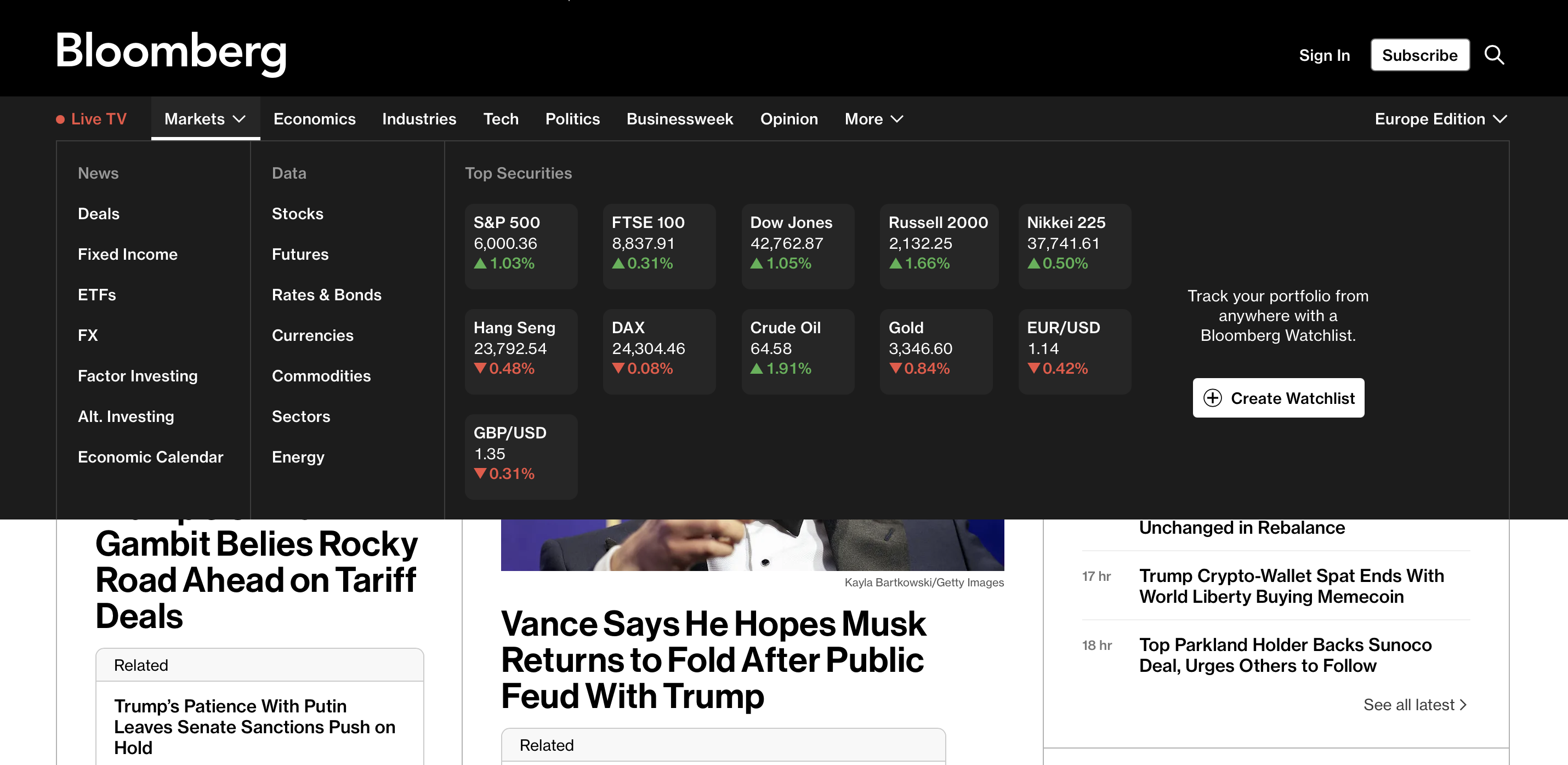

3. Bloomberg — financial market news.

To be aware of the main events on the stock market, you need to read the news. Bloomberg is the primary source of most news. Therefore, to avoid distortion of information, it is better to immediately search for and read it in the primary source and in the original language.

The site, however, has quite limited free functionality — after reading a few articles, for further widespread use, you need to purchase a subscription. But, understanding that Bloomberg is the primary source, you can search for information on free news sites or information aggregators and, seeing a link to Bloomberg, understand that this material is worth paying more attention to.

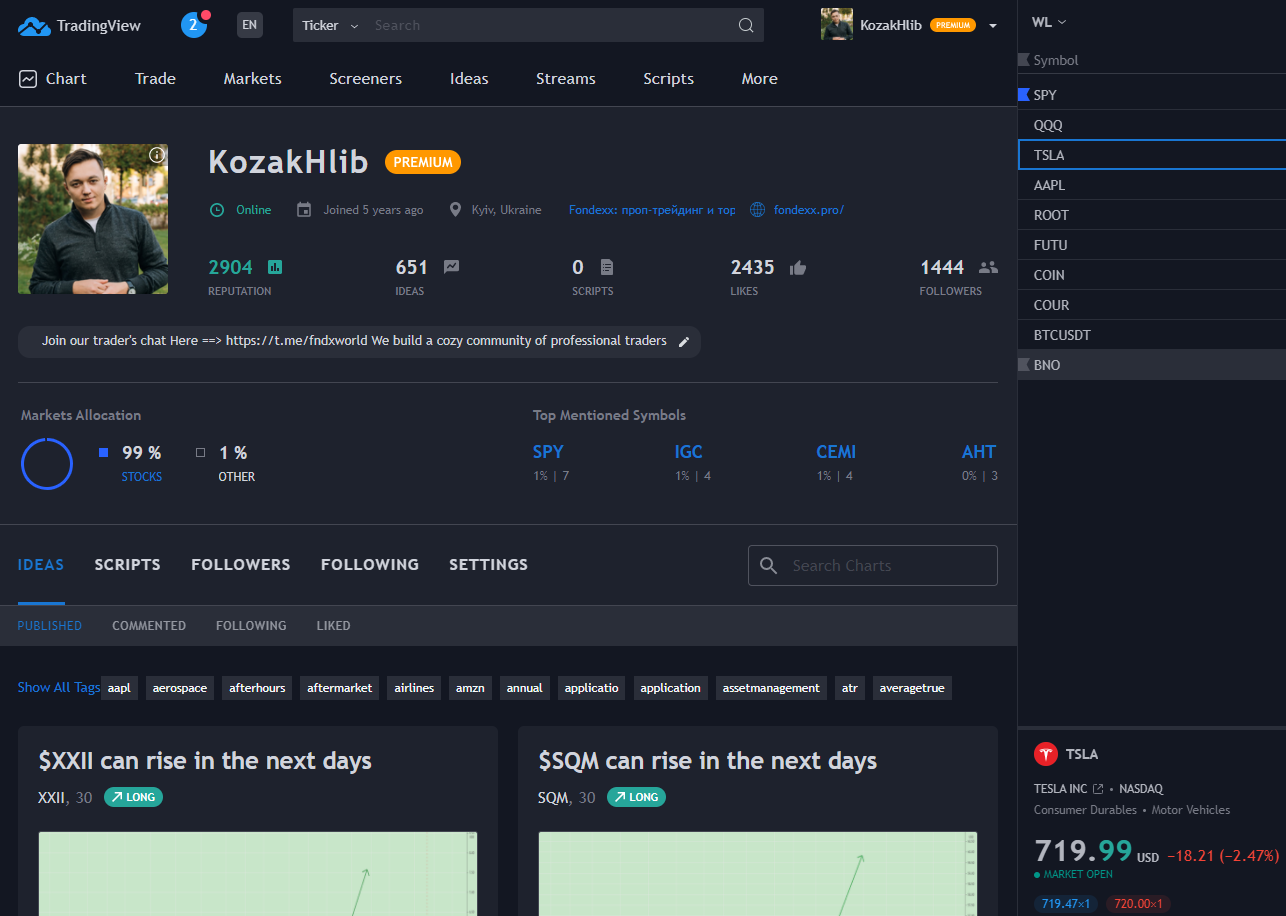

4. Tradingview — work with charts, analytics, trading ideas, signals (in particular from Fondexx), market sentiment.

The most convenient and, as a result, popular site for working with charts. Users have access to a wide range of functionality for visualizing their ideas on a chart, a variety of technical indicators, as well as the ability to write their own indicators. The Tradingview format allows you to blog and publish your own trading ideas. 15 minutes after publication, a post with a trading idea cannot be deleted, so subscribers have the opportunity to check the quality of the published ideas in dynamics.

Fondexx blog on Tradingview, where signals are published for most of the strategies that we trade in prop and teach in TradingSchool.

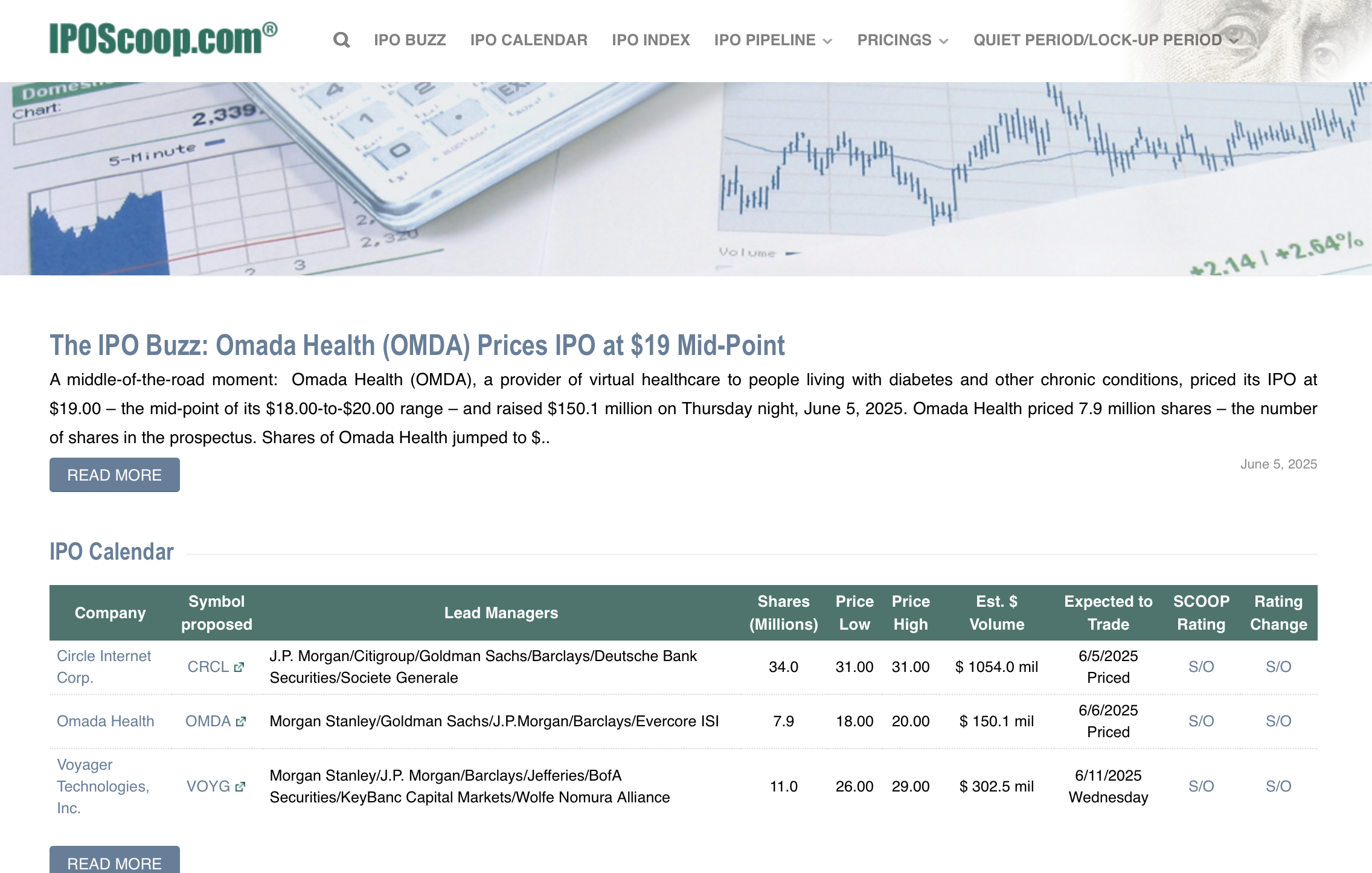

5. IPO-scoop — aggregator of IPO stocks.

The most convenient service for tracking IPO stock activity. The site has a calendar where it is easy to see IPOs that will soon start public trading. Available information: trading start date, ticker, range or placement price, etc. This is the service we use when selecting stocks for the IPO Intraday strategy.

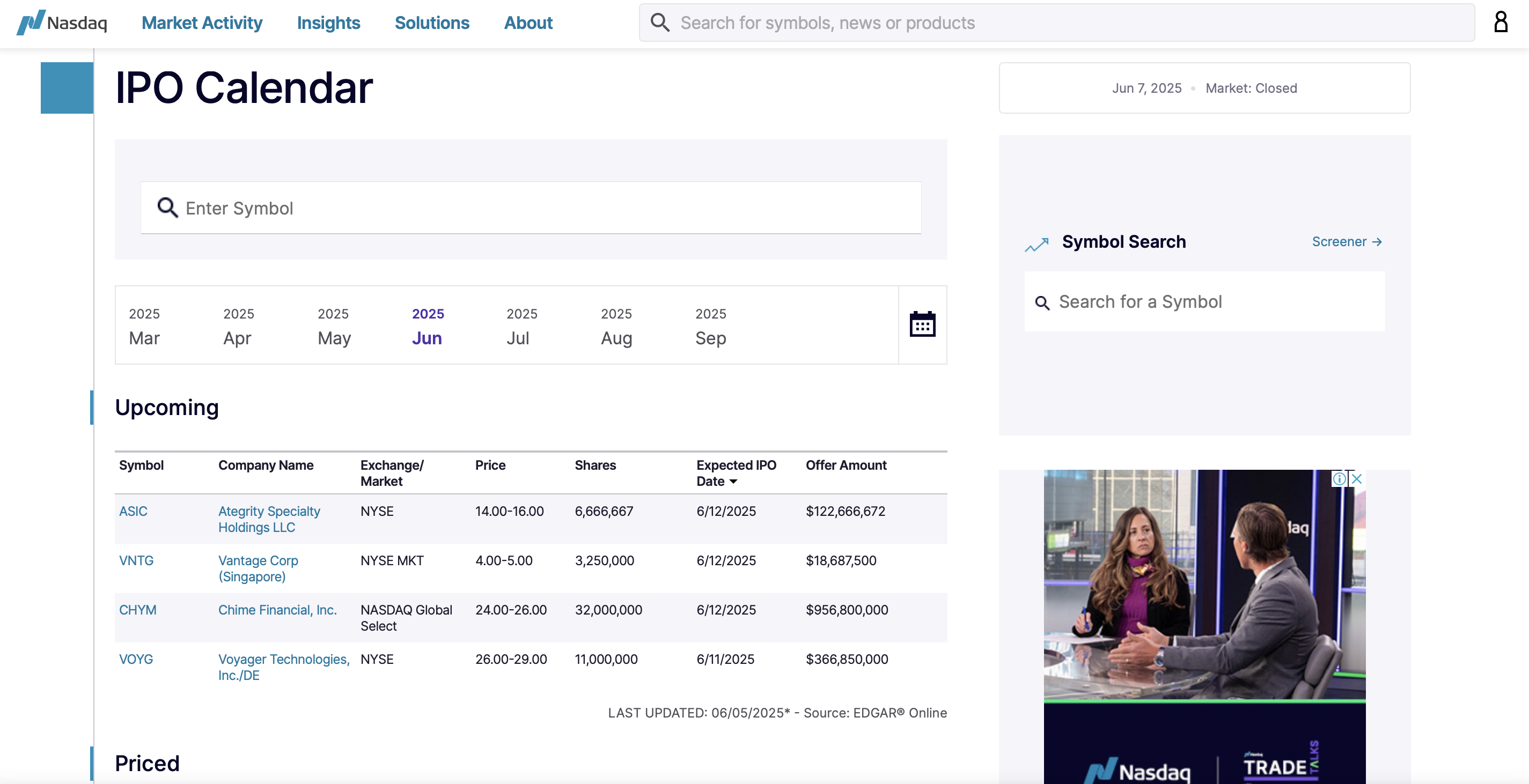

6. IPO-calendar — IPO calendar from Nasdaq.com, history of all IPOs for 10 years.

This calendar is convenient to use for analyzing the history of IPOs, it contains a database for the last 10+ years. It is from here that we downloaded all the statistics when preparing the report “IPO Hype: Another Attempt to Beat the S&P500”.

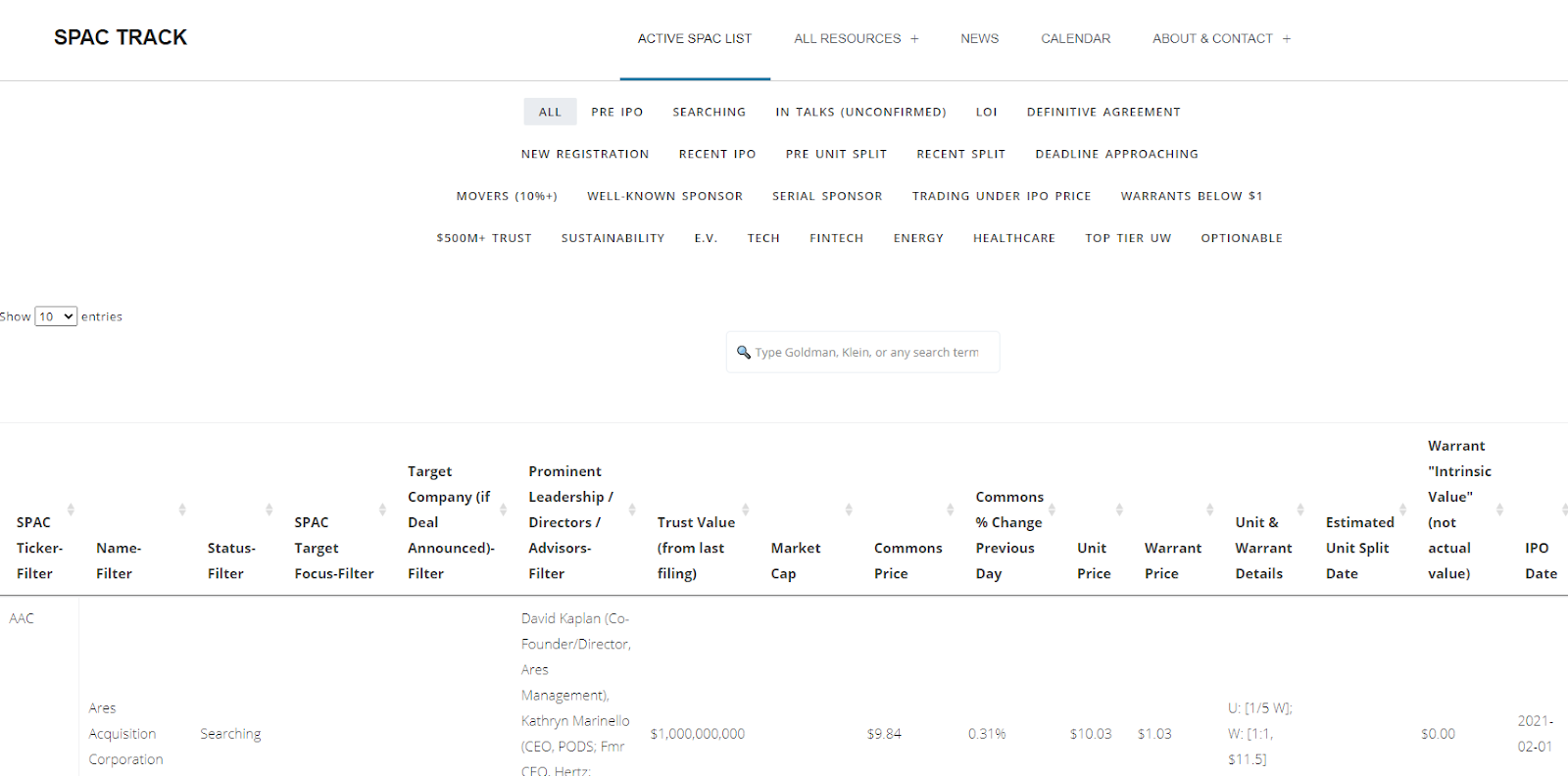

7. Spactrack — all information about SPACs for traders and investors.

A convenient service that collects all the information specifically about SPACs: IPO date, volume, Definitive Agreement date, who they plan to merge with, etc. The service has a Twitter account where you can quickly follow the news.

8. Biopharmcatalist — all information about biotechs for traders and investors.

A convenient aggregator of information on companies in the biotechnology sector (medicine and healthcare). Here you can find an FDA stage calendar with an archive for several years, optimized for the screener industry, analytics and industry news.

9. ETF Database is a platform for ETF analysis.

All existing ETF funds are collected here and structured according to various parameters - asset class and size, sector, industry, geography, investment style and many other parameters. For each fund, the entire specification is provided - issuer, management fee, what the fund consists of and how it is formed, capital flows, etc.

10. Shortqueeze is a service for shorts and those who arrange for them to squeeze.

After the noise around GME and Wallstreetbets, analysis of short float - the percentage of the number of shares in circulation that were borrowed by traders to open short (short) positions - became especially relevant. This service copes with this task best. The site has a convenient thematic screener, access to short float indicators in history, in-depth analysis of current opportunities related to short float, and much more.

If stocks with a large short float begin to grow sharply, the probability of a short squeeze increases. And short squeeze is a great opportunity to earn money by pulling out the stops of short traders. If you are not familiar with all these terms, we recommend taking one of our training courses.

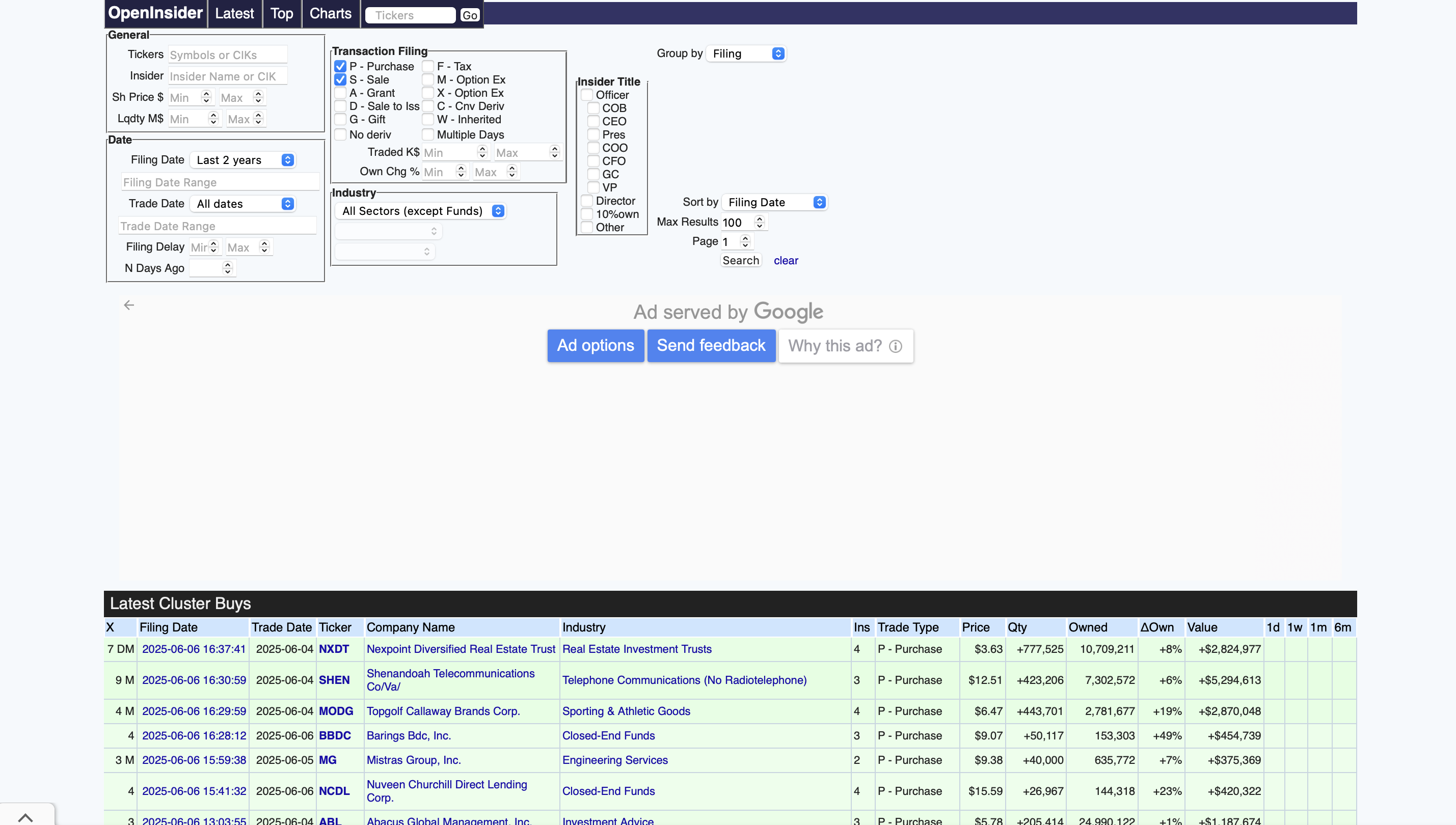

11. Openinsider is an insider trading screener.

Another highly specialized platform, this time for analyzing insider trading. The site updates information on transactions that insiders have reported to the SEC in real time. There is also a specialized screener that will help you select the necessary information: date and time of the transaction report, volume, average execution price, etc. An archive of information is available, which will be useful when analyzing history. Insider trading is a parameter that professional traders must take into account and use in trading.