Avoiding losses is one of the most common tasks in trading. For that purpose, you can use such types of orders as Stop (Stop Market) and Stop Limit.

Stop Limit orders are recommended to be used only for fixing losses.

We would like to clarify that Stop Limit orders cannot be used for fixing take-profit and stop-loss.

*To get more details on how to set Stop Loss and Take Profit, please refer to the platform manual

How the Stop (Stop Market) order works?

Stop Market - when placing this order, by choosing the Stop price, you choose the trigger price.

What does it mean? It means that when the price you have chosen is reached, the Stop Market order will be converted into a market order and will be sent at the current market price.

Example:

| Buy Stop market | Sell Stop market |

You have sent a Buy Stop Market order to buy 100 shares of XYZ stock. As soon as the ticker price reaches 112.00, the order will be triggered and a Buy market order will be sent at the Ask price | You sent Sell Stop Market an order to sell 100 shares of XYZ As soon as the ticker price reaches 112.00, the order will be triggered and sent Sell market order at Bid price |

How does a Stop Limit order work?

Stop Limit - when setting a Stop Limit order, you specify a Stop price and a Limit price.

What does it mean? It means that when the Stop price (trigger price) you specify is reached, the Stop Limit order is converted into a Limit order.

Example:

| Buy Stop Limit | Sell Stop Limit |

You have placed a Buy Stop Limit order, 100 shares of XYZ stock You have specified the Stop price - 10.50 For a Buy Stop Limit order, the Limit price must always be higher than the Stop price (at least 5 cents). Accordingly, the Stop Limit order will trigger at 10.50 and send a Buy Limit order at 11.00 (it will be executed at the specified price or better) | You place a Sell Stop Limit order, 100 shares of XYZ stock You set the Stop price at 10.50 For a Sell Stop Limit order, the Limit price must always be lower than the Stop price (at least 5 cents). Accordingly, the Stop Limit order will trigger at 10.50 and send a Sell Limit order at 10.00 (it will be executed at the specified price or better) |

!!! You cannot place a Sell Stop or Sell Stop Limit order above the current market price, as the order will be executed instantly

!!! You cannot place a Buy stop or Buy stop Limit order below the current market price, as the order will be executed instantly

Alpha Trader and RT: The specifics of these orders on the platforms

Stop Limit - for this type of order, you need to fill in two fields in the Trade tab:

In the Price field - you need to write the Stop price

In the Limit Price field, you should write the Limit price

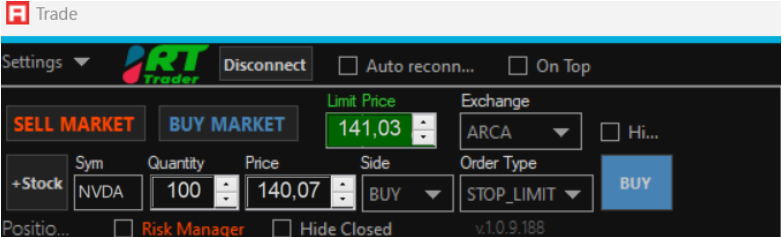

| Buy Stop Limit | Sell Stop Limit |

You have placed a Buy Stop Limit order, 100 shares of NVDA In the Price field, you set the price to 140.70 For a Buy Stop Limit order, the Limit price must always be higher than the Stop price (at least 5 cents). Accordingly, the order will be triggered at the price of 140.70 | You have placed a Sell Stop Limit order, 100 shares of NVDA In the Price field, you set the price to 15.99 For a Sell Stop order, the Limit price must always be lower than the Stop price (at least 5 cents). Accordingly, the order will be triggered at the price of 15.99 |

What is the difference between STOP LIMIT and STOP LIMIT SMART orders?

The functionality of these orders is the same.

The only and the most important difference is that if you want to send a STOP LIMIT order on the pre-market, you must use the STOP LIMIT SMART order type, otherwise the order will not work.

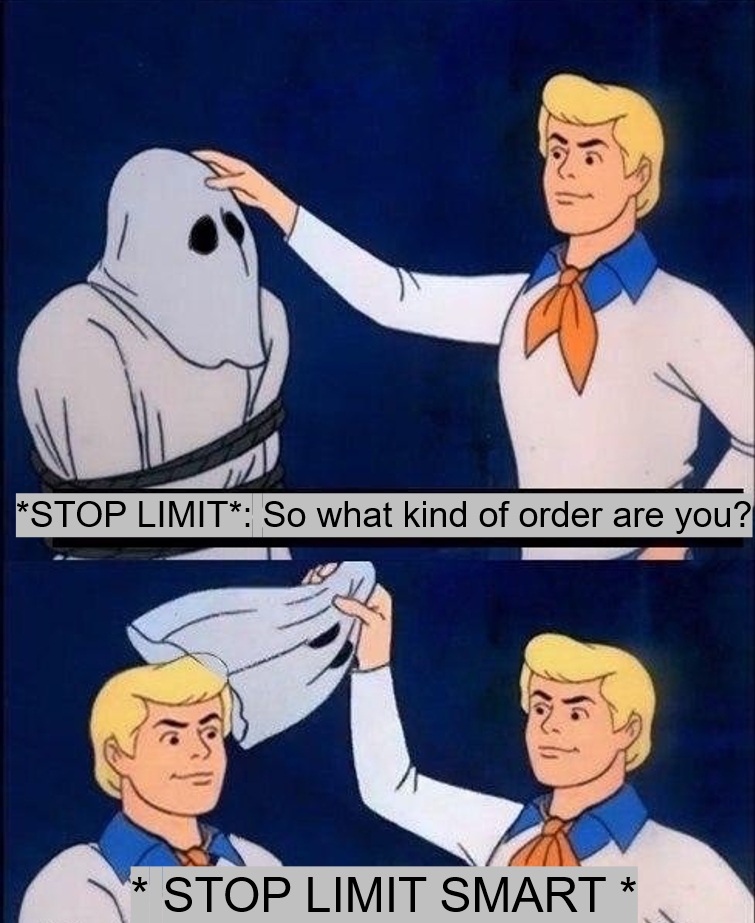

This type of order can be placed through the Trade window

Select the order type in the Type field as shown in the screenshot:

How these order types work for the demo account

Please note that the following order types do not work for demo accounts

STOP LIMIT

STOP LIMIT SMART

Accordingly, when trading on a demo account for the premarket, you need to use the LIMIT order type

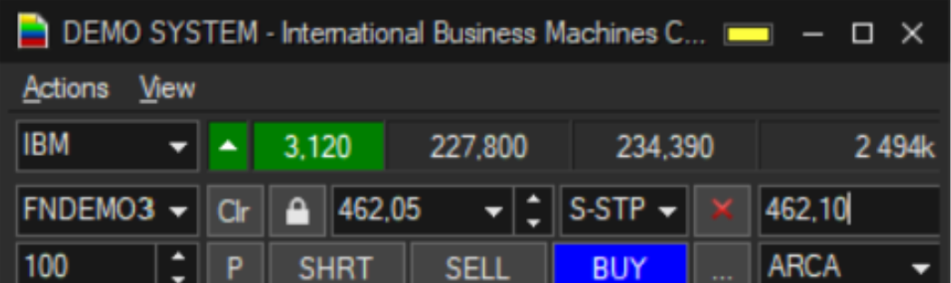

Sterling Trader Pro: How it works on the Sterling Trader Pro platform!

Please note that we recommend using GSTOP instead of S-STP as a Stop Market order.

This minimizes the risk that the Stop-Loss may not be triggered upon reaching the appropriate price.

How to set up GSTOP:

- You need to select TIF: STP

- ECN: GSTOP.

- In the Price field: specify the price of the Stop order

For Stop Limit order

How to set up :

- TIF must be selected: S-STP

- ECN: ARCA

- In the Price field: specify the price of the Stop order

- In the empty field on the right: specify the price of the Limit order

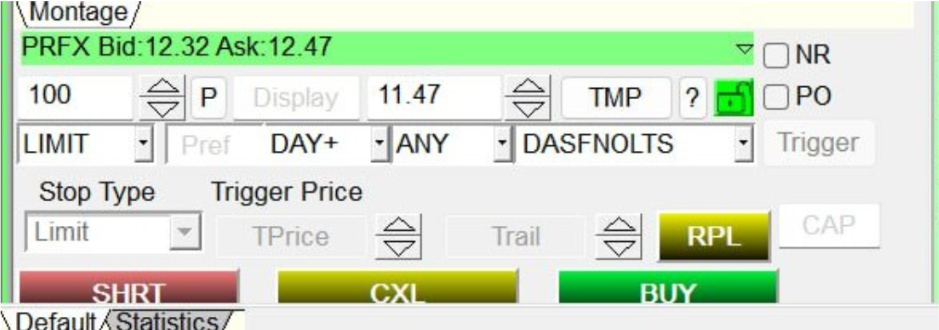

DAS Orders on the DAS platform

Example of setting up a Stop Market order

Settings for Stop Limit

If you have any questions, please contact us at this telegram account @fndxaccounts

We will be happy to help you understand these types of orders!