Stop Order Basics: Understanding a Key Trading Tool

Stop orders, often referred to as stop-loss orders, are among the fundamental tools in trading, offering investors a way to manage risks and execute trades automatically based on price movements. These orders are designed to provide precise control over transactions while automating the process of buying or selling securities when specific price conditions are met. Below, we delve into the essential aspects of stop orders, their functionality, advantages, limitations, and how they compare to other order types.

Source: learn.bybit.com/

What is a Stop Order?

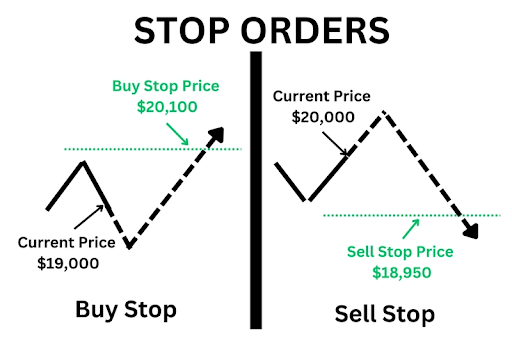

A stop order is a trading instruction to buy or sell a stock once its price reaches a predefined level, known as the stop price. When this price is met or exceeded, the stop order converts into a market order, allowing the transaction to be executed at the next available price. Stop orders are dynamic, always acting in the direction of the market’s movement. For example:

- Sell Stop: This order is triggered when the market price falls to or below the stop price, initiating a sale to limit further losses or lock in profits.

- Buy Stop: This order activates when the market price rises to or above the stop price, enabling investors to enter positions during upward trends.

How Do Stop Orders Work?

Stop orders are placed on the order book but remain dormant until the stop price is reached. Once triggered, they transform into market orders, executing at the best available price. This execution mechanism means the final trade price may differ from the stop price due to market conditions, such as volatility or liquidity constraints.

Advantages of Stop Orders

- Risk Management: Stop orders provide a safeguard against significant losses by automating trade execution when prices move unfavorably.

- Profit Protection: Investors can lock in gains by using stop orders to sell or buy at predetermined price levels.

- Automation: By removing the need for constant monitoring, stop orders simplify the trading process, especially for those unable to watch the markets continuously.

Disadvantages of Stop Orders

- Price Slippage: In volatile markets, the execution price may differ from the stop price, potentially leading to less favorable outcomes.

- Premature Triggers: Short-term fluctuations can activate stop orders, resulting in unintended transactions.

- Execution Uncertainty: If the stop price isn’t reached, the order remains unexecuted, which may hinder certain trading strategies.

Stop Orders vs. Other Order Types

Stop orders can be contrasted with other common order types:

- Stop-Limit Orders: Similar to stop orders, these are triggered by a specific price but will only execute within a predefined range. While offering greater control, they may not execute if the market moves outside the limit range.

- Market Orders: These are executed immediately at the current market price, regardless of specific price levels. Unlike stop orders, market orders guarantee execution but lack price precision.

- Limit Orders: These execute at a specified price or better, providing control over transaction costs but no guarantee of execution if the market doesn’t reach the set price.

Source: www.investorsunderground.com/

When Should You Use Stop Orders?

Stop orders are particularly useful in scenarios where investors aim to:

- Minimize Losses: By setting a sell-stop order below the current price to exit a losing position automatically. (in the article via the link we described strategies better)

- Protect Gains: By placing a buy-stop order above the current price to secure profits in an upward trend.

- Enter Breakouts: By using buy-stop orders to enter positions during significant market movements.

Practical Tips for Using Stop Orders

- Set Appropriate Levels: Avoid setting stop prices too close to the current market price to reduce the risk of premature triggers from normal price fluctuations.

- Understand Brokerage Policies: Different brokers have varying rules for determining when stop orders are triggered. Always verify these policies before placing an order.

- Account for Costs: Be mindful of potential additional fees associated with stop orders, especially if multiple trades are triggered.

Risks of Using Stop Orders

- Market Volatility: Rapid price swings can cause slippage, resulting in execution at prices far from the stop price.

- Liquidity Issues: In low-liquidity markets, stop orders may partially execute or fail to execute altogether.

- Market Gaps: Large gaps in price between trading sessions can lead to executions at prices significantly different from the stop price.

Conclusion

Stop orders are a powerful tool for traders and investors looking to automate their strategies and manage risk effectively. By understanding their advantages, limitations, and best practices, traders can harness the potential of stop orders to protect investments, optimize gains, and maintain control over their trades. While not immune to market conditions like volatility and liquidity gaps, stop orders remain an essential element in the toolkit of any disciplined trader.