Long-term investments are one of the key strategies that allow you to grow your capital over a long period of time. It is also one of the most effective ways to protect your savings from the effects of inflation.

But what exactly are they, and how do they work in the stock market? Let's take a closer look at this topic.

What are long-term investments?

Classically, long-term investments are those for a period of more than 1 year. Such investments are not aimed at obtaining small short-term profits, but are based on systematic investment in assets that have a long-term growth prospect with risks suitable for the investor.

Long-term investments include:

Equity shares and ETFs;

Government bonds and bank deposits;

Investment funds;

Real estate;

Collectibles and precious metals.

Comparing long-term investments with active trading, there are several main differences between them. Let's divide them into advantages and disadvantages:

Advantages:

Require less time. Active trading requires daily involvement of a trader, analysis and control of positions. A passive investor can dedicate a minimum of time or even entrust this matter to an investment fund.

Lower risk from volatility. Long-term investments help to reduce the impact of short-term market volatility, as the result is considered over a longer period of time.

The ability to capitalize investments. An investor can regularly increase his or her position in various assets, which increases the final effect of the investment.

Disadvantages:

Lower expected return. Investments are primarily aimed at preserving and increasing capital in the long term.

There is a reliability risk. Since the investor's funds are invested for a long time in a certain asset (or under the management of a fund), one must be sure of the reliability of one's own investments.

Lower liquidity. The size of investments in investing is usually much larger than short-term positions in trading. Fixing profits can be difficult.

Some options have a high entry threshold. For example, funds can only accept investments from a certain amount. Investments in gold are limited to the price of the bar/coin, and in real estate to the price of an apartment or house.

What is the yield on long-term investments?

The yield on investments directly depends on their riskiness. There is a correlation: the lower the risk, the lower the yield. US Treasury bonds are considered to be the benchmark of reliability in investments - they are often called a “risk-free investment”. Accordingly, the yield is also relatively low - on average, it is about 4% per annum.

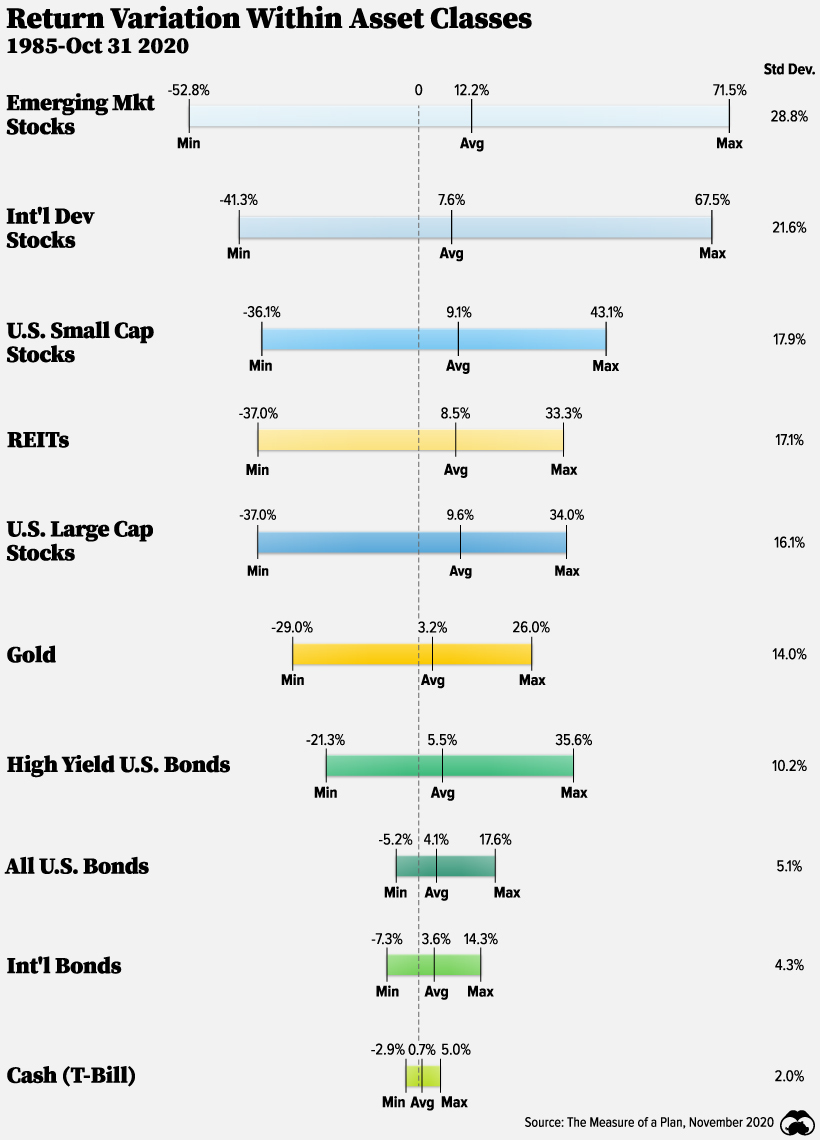

What is the average annual yield on other assets? The infographic contains information for 35 years on the yield of each popular instrument: stocks, real estate, gold, and bonds:

Average annual investment returns by asset class for 1985-2020 (c) www.visualcapitalist.com

Among other assets, stocks have the highest average return. At the same time, stocks also have the highest standard deviation - in other words, riskiness. But how can you make long-term investments in the stock market profitable while minimizing risk? Let's take a closer look.

How can you invest in the stock market?

The history of stocks goes back more than 400 years. During this time, they have undergone many changes, regulations, and have acquired a large number of derivative instruments. However, the essence of investing in stocks has remained unchanged for a long time: investors have been building a portfolio of shares and expecting them to grow gradually or pay dividends.

When you bought a stock and it fell by 20% in a week

The situation changed with the emergence of private companies that were ready to manage investor funds - Mutual funds. Every investor could no longer research stocks for investment on their own, but simply entrust this work to a mutual fund.

And in the early 1990s, the situation became even simpler due to the creation of a new type of fund - ETF (Exchange Traded Fund). Shares of these funds are traded directly on the stock exchange, and to invest in such a fund, it is enough to simply buy them through a broker.

So, the main types of investments in the stock market are:

Portfolio investments. An investor can build his or her own stock portfolio by choosing different companies and dividing his or her investments among them. It is necessary to have sufficient expertise for a quality stock selection, or consult a financial advisor.

Investing through investment funds. You need to choose a fund that suits your goals and purchase a share in this fund. Fondexx also has an investment fund - you can request an investment presentation from the manager.

Investing through ETFs. The principle is similar to investing through mutual funds, but to work with these funds, you can simply buy shares of the fund on the stock exchange. Fondexx allows you to purchase shares of any ETF traded on the US stock market.

3 important things about investing in the stock market

Stocks need no introduction, and they are invested in by a large number of investors around the world. But there are at least 3 things that will increase your confidence in this asset.

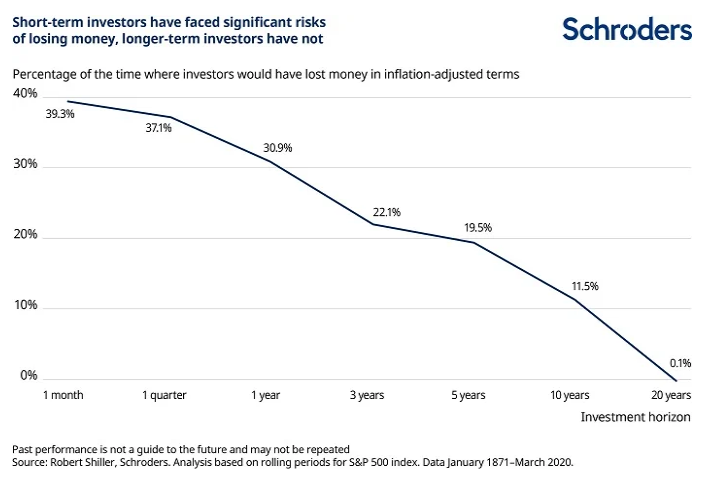

The first is that the longer you hold a position, the lower the chance of its loss. The chance of closing a random position on the S&P 500 index in the red if you hold it for a month is 39.3%. But if you hold such a position for a year, this percentage is already 30.9%. On a 10-year horizon, the percentage approaches 10%. And on the 20-year horizon, it becomes negligible: out of 1551 periods analyzed, there was only one period when investments made a loss (adjusted for inflation).

So investing in stocks, you have a statistical advantage due to time.

Probability of losing money on the stock market depending on the period of holding a position (based on data for the last 150 years). (c) www.moneylens.com

The second is the Dollar-Cost Averaging (DCA) strategy. DCA is one of the most common and effective strategies for investing in stocks. It is based on a simple principle: regularly investing the same amount of money in a selected stock portfolio, regardless of the stock price on the market.

Equity crowding makes investments more affordable and less vulnerable to market volatility. This strategy allows investors to plan for the long term and achieve their financial goals with more confidence.

Third - Diversification. Diversification is a key principle in investing. It involves the distribution of investments between different assets from different sectors of the economy. The basic idea is the well-known saying “don't put all your eggs in one basket”.

Stocks have a significant advantage in this regard, as companies from all possible sectors of the economy are listed on the stock exchange - from raw materials to the high-tech sector. You can have stocks from the financial, technology, and healthcare sectors in your portfolio at the same time, all within the same ETF.

To summarize

Long-term investments are not only a way to secure your future and achieve financial independence, but also an effective way to protect your savings from the effects of inflation. They allow investors to withstand temporary market fluctuations and benefit from the long-term growth of the global economy, while investing a minimum of time and effort.

As your reliable partner in the world of investments, the Fondexx team is always ready to provide professional support and reliable access to the markets. We will be happy to help you open an investment account and start your own journey to financial stability.