What is a short position?

A short position is a type of transaction in which an investor sells shares that he or she does not own in the expectation that their price will decline, i.e., the opposite of a long position.

Here's how it works:

Borrowing: A short seller borrows a security from a broker or another investor. This borrowed security is then sold on the open market.

Selling: The short seller sells the borrowed securities to a buyer who wishes to purchase them, resulting in a cash inflow.

Redemption: To close a short position, the seller has to buy back the same number of shares as he borrowed. The goal is to buy them at a lower price.

Return of borrowed shares: After the shares are bought back, they are returned to the lender.

Profit or loss: The profit or loss is determined by the difference in price between the initial sale and the repurchase. If the price falls, the short seller makes a profit; if it rises, he or she suffers a loss.

The main differences between long and short positions

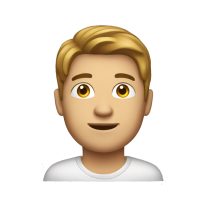

The key difference between long and short positions lies in the investor's attitude toward the value of the stock. A long position is a bullish strategy that assumes the price of a stock will rise, while a short position is a bearish strategy that assumes the price of a stock will fall.

Short selling is conducted through a margin account, as it requires borrowing securities from a broker, with the account serving as collateral for potential losses. Long positions are generally considered less risky than short positions because an investor can profit from a rising stock price, while short positions can lead to unlimited losses if the stock price continues to rise.

What are “Hard To Borrow” and “Easy To Borrow” stocks and what are the differences?

The terms “hard to borrow” and “easy to borrow” refer to the availability of shares for short selling in the financial markets. The difference between hard to borrow (HTB) and easy to borrow (ETB) shares is based on the ease or difficulty of finding and borrowing shares for this purpose.

Easy-to-borrow stocks are securities that are easily available for short sale. These stocks often belong to large, well-known companies with high liquidity. The availability of such stocks is usually high, making it easier for traders to implement short-selling strategies. Borrowing costs for these stocks are usually lower or free with certain brokers, including Fondexx.

For example, blue chip stocks of major indices that are frequently traded and have a sufficient supply are referred to as ETB stocks or e.g. Ford, Tesla, etc.

Hard to borrow stocks are securities for which it is difficult to find available shares to borrow for short selling. This category may include shares with limited circulation (shares available for trading), shares with smaller capitalization or shares with lower liquidity are likely to be difficult to borrow. The cost of borrowing for such shares may be higher due to the scarcity of available shares.

For example, stocks of companies with low market capitalization, limited trading volume or high institutional ownership, usually the majority of shares traded in the Pump&Dump strategy are also HTB.

How to distinguish between them in practice and how to borrow them will be discussed further in the practical part using a demo account.

How do I open long and short positions?

There are several ways to take long and short positions on the stock market. One of them is to buy or sell shares directly and thanks to prop companies like Fondexx, this does not require significant capital but does require some knowledge. The other way is to use derivatives such as futures, options or contracts for difference (CFDs), which allow investors to speculate on stock price movements without actually owning the stock.

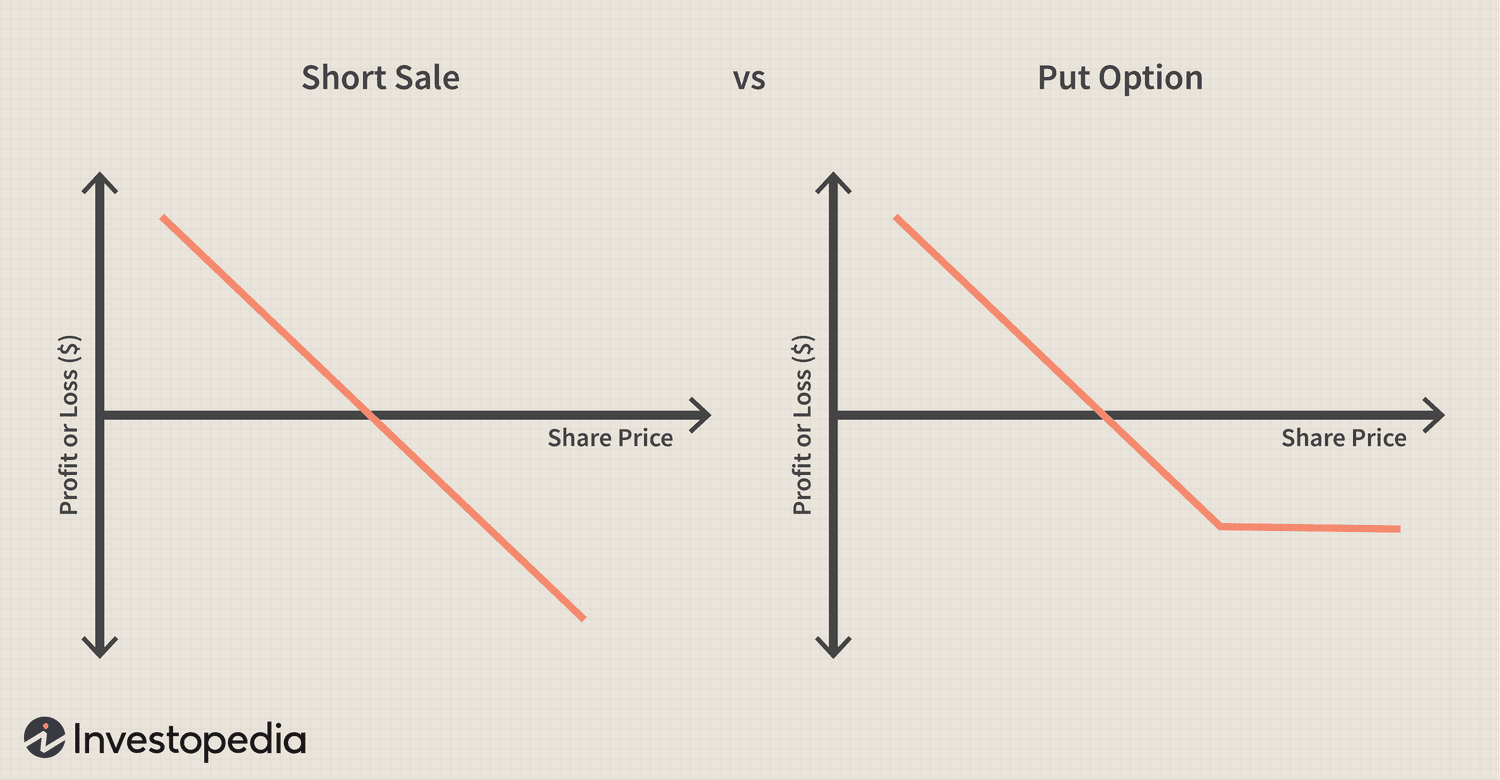

To understand how it looks like in practice, just visit our website and after a short registration in your Personal Area, using the example of the Alpha Trader Pro platform, follow the simple steps in the following instructions:

1. Installing the platform, in our case Alpha Trader Pro (more detailed instructions from our YouTube channel)

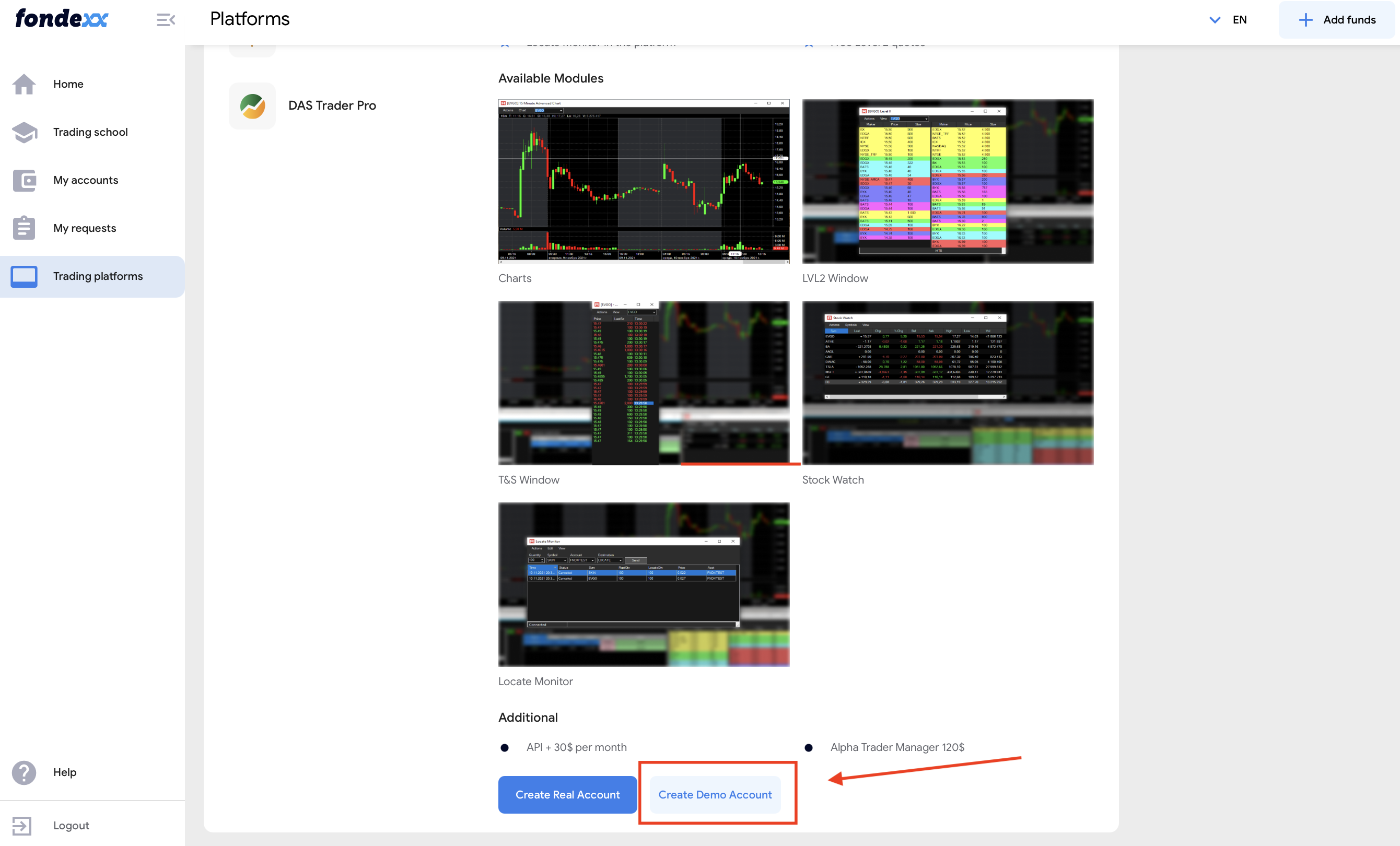

2. Authorization in the Alpha platform using the data from the Personal Cabinet

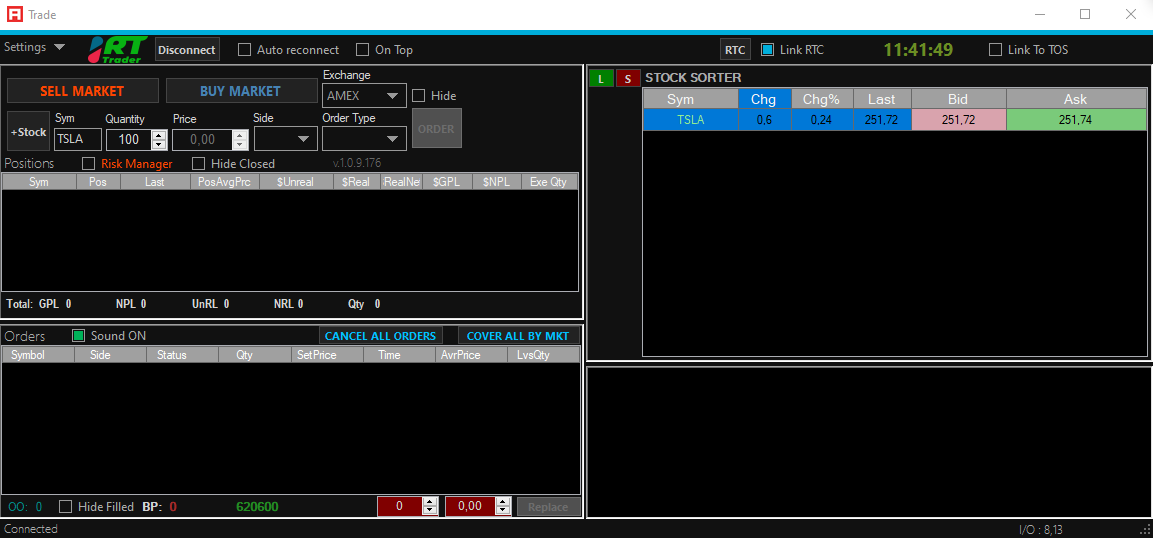

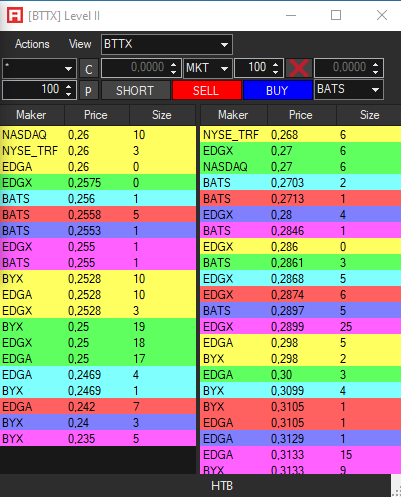

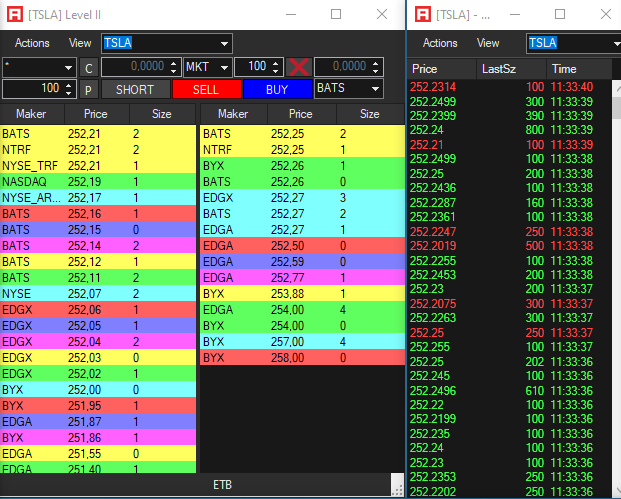

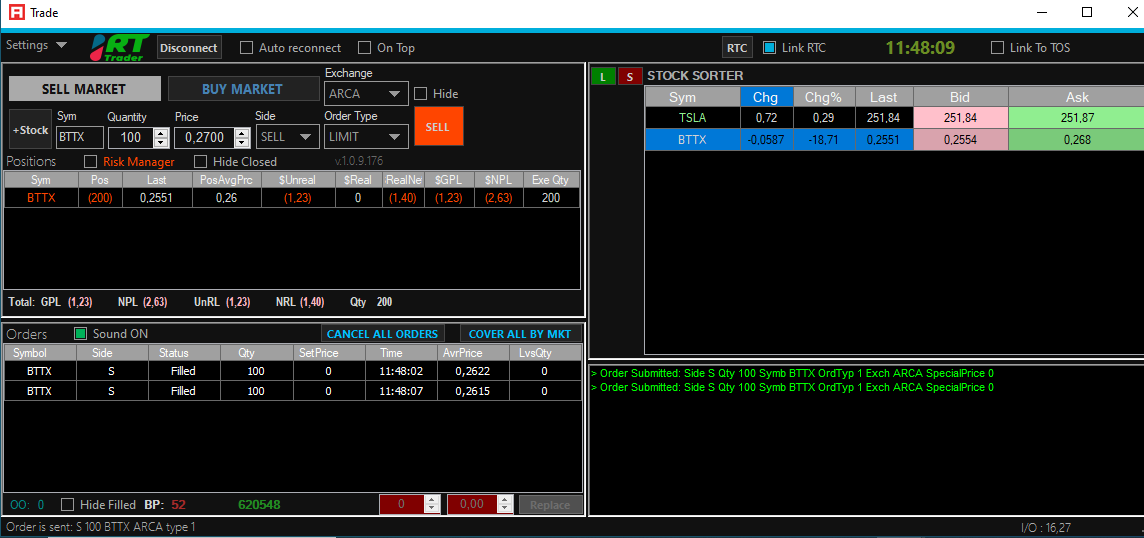

3. In the Trade window, we add the desired stock, in our case TSLA and BTTX to the Stock Sorter. After that, if the LEVEL 2 window is linked together with the Trade terminal, we will see at the bottom of the glass (Level 2 window) what type of availability the stock belongs to - ETB or HTB.

4. Further, everything will be analogous to what is described in the article What is Long, so I advise you to read it first for a more detailed understanding.

In the case of an ETB share, we can immediately select the number of shares 100, the type of order MKT (Market Order) and click the Short button, because the broker allows us to short it immediately without borrowing it first.

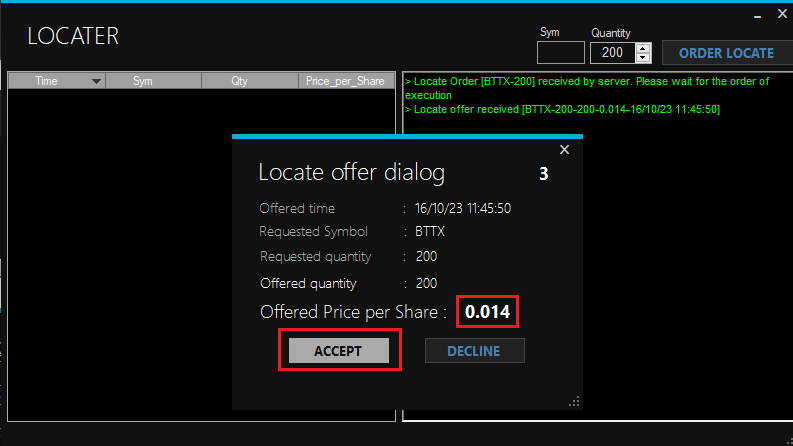

5. If the share is HTB, then we will need the Locater window to borrow it from the current owner.

It can be found by opening the Trade - Settings - Locater window.

In it, we enter the stock ticker and the amount we want to borrow, then the HTB share will become available to us in a SHORT trade.

6. If the order is executed, then in the Trade window, in the Positions field, we will have an active Short position.

In order to close it, you need to either buy the same share in the same quantity at the current price or click on the position and choose to close it at the current price.

Congratulations, you have executed your first SHORT trade!

Risks and Considerations

Short selling is a tactic with inherent risks that investors should be aware of:

Unlimited loss potential: Although the potential profit is limited to 100% (if the stock price falls to zero), the losses on a short position can be theoretically unlimited if the price of the security increases significantly.

Borrowing costs: Short sellers pay commissions and interest on borrowed shares, which increases the cost of trading.

Margin requirements: Brokers may require short sellers to maintain a margin account with sufficient funds to cover potential losses, which increases capital requirements.

Timing risk: Short sellers must accurately time their trades, as markets may remain irrational for longer than expected.

Short Squeeze and risk management

A Short Squeeze occurs when a stock with a large shortage experiences a sudden price increase, forcing short sellers to rush to buy back shares to limit their losses. This surge in buying can exacerbate the price increase, creating a domino effect. To manage risk, short sellers often use stop-loss orders to limit potential losses.

Regulatory Oversight

Short selling is regulated in the United States by the Securities and Exchange Commission (SEC) to prevent market manipulation. The SEC implements "uptick" and "circuit breaker" rules to maintain market stability.

Conclusion

Short trading is a complex and high-risk type of trading that can be profitable if executed correctly. They are an integral part of the US stock market, providing liquidity and opportunities for traders. However, before resorting to short selling, it is important to understand the risks involved and have a well thought out risk management plan in place. The potential benefits of a short position include the ability to profit from a stock's decline, as well as the flexibility to exit a trade quickly. However, there are also certain risks. If the price of a stock rises instead of falls, the investor may suffer losses, and there are no limits to how much the price of a stock can rise.

As with any investment strategy, careful research and consultation with financial professionals is crucial, so don't be lazy and contact our friendly support team to install our free software and experience the practical side of trading US stocks. Also, register on our website to get access to training courses, other interesting articles and get advice on how to become a profitable trader and what to do step by step.