What is SPAC?

A special purpose acquisition company (SPAC) is a company that acquires or merges with another business. In other words, it is a kind of “empty shell” that does not conduct its own business but goes public to attract investors and then uses funds to purchase an existing private company.

Investors are investing in the trustworthiness of SPAC and the team that created it. They do not know in advance exactly which business their funds will go to.

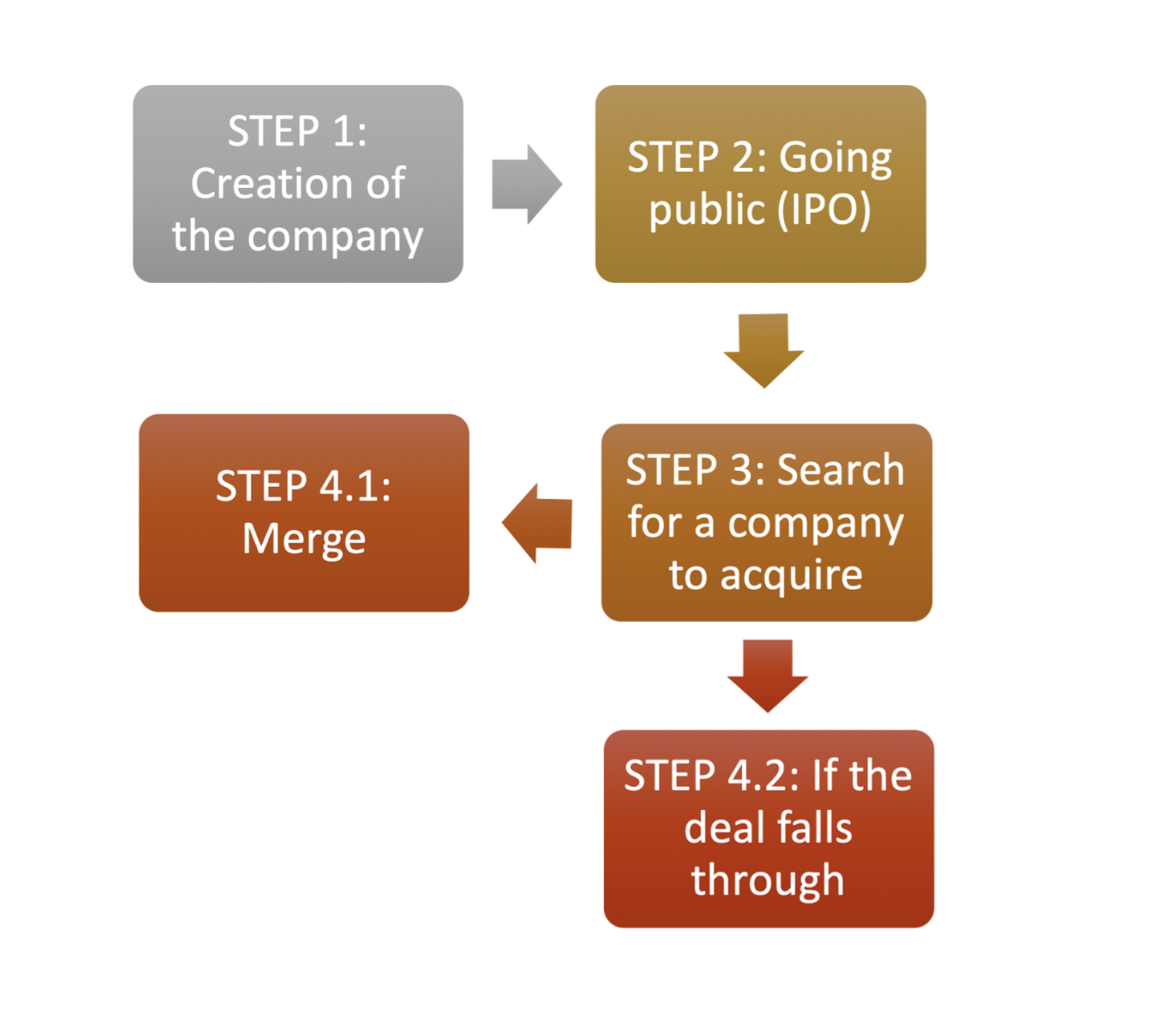

How does a SPAC work?

To understand the essence of SPAC, it is worth considering its operation step by step.

Step 1: Creation of the company

A group of experienced investors or entrepreneurs creates a legal structure - a company without its own operations or income. The team is called SPAC sponsors.

Step 2: Going public (IPO)

SPAC conducts an initial public offering (IPO) and raises funds from investors. Shares are usually sold at a fixed price - about $10 per share. All the money raised goes into a trust account and cannot be used for anything other than acquiring a future target.

Step 3: Search for a company to acquire

After the IPO, sponsors have a limited amount of time - usually 18 to 24 months - to find an interesting private company with which they want to merge. This could be a startup in technology, biotechnology, fintech, or even the manufacturing industry.

Step 4.1: Merge

When the selected company agreed to cooperate, a merger process (called De-SPAC) took place. As a result, the private company automatically becomes public - without the complicated procedure of a traditional IPO.

Step 4.2: If the deal falls through

If the team fails to find a suitable company within the specified time frame, the SPAC is liquidated and all invested funds (with interest) are returned to shareholders.

Why have SPACs become popular?

SPAC companies have been around since the 1990s, but they took off in 2020-2021. During this period, global markets experienced high liquidity, and investors were looking for new ways to multiply their capital.

There were some reasons for the popularity of SPACs:

Speed: A traditional IPO can take anywhere from six months to a year, while going public through a SPAC allows a company to go public in a matter of months.

Less bureaucracy: The process of merging with a SPAC is simpler than going through the stages of a classic IPO.

Flexible terms: The company being acquired by the SPAC could negotiate the details of the deal without market pressure, which is often beneficial for startups.

Well-known sponsors: Many SPACs were led by prominent businesspeople, including former executives of large corporations or Wall Street investors. This increased confidence and trust to the SPAC entity.

Examples of popular SPAC cases

During the boom years, many well-known companies went public through a SPAC. Here are some of them:

VIRGIN GALACTIC - Richard Branson’s space tourism company

DRAFTKINGS - a sports betting platform, which was merged with a SPAC in April 2020 and has since become a successful example of a SPAC-born company

WEWORK - Merged with a SPAC in October 2021 after its initial IPO was withdrawn in 2019.

LUCID MOTORS - Tesla’s competitor in the electric car sector

NIKOLA - electric truck manufacturer, which went public through a merger with VectoIQ (SPAC)

Some of them have successfully retained investors' confidence, but others, such as Nikola, have suffered serious reputational and financial losses.

Source: https://fuelcellsworks.com/

In 2020, Nikola went public through a SPAC merger, without a traditional IPO. Its founder, Trevor Milton, actively promoted the company as “Tesla’s future competitor”, promising revolutionary hydrogen truck technology.

These statements caused a real stir: Nikola’s capitalization grew to over $30 billion, even though the company did not actually have serial production and did not generate real income.

Later, journalistic investigations and a report by Hindenburg Research revealed that many of Nikola’s demonstrations and presentations were staged. For example, during the demonstration of the “hydrogen truck”, it simply rolled down a hill rather than moving under its own power.

Thus, Nikola attracted investors’ money by selling promises of technological breakthroughs that did not actually exist. After the scam was exposed, the company’s shares plummeted, and Trevor Milton was charged with fraud and convicted in 2023 for misleading investors.

Key risks of SPACs

Despite their advantages, SPACs have many significant risks that every investor should be aware of:

1) Uncertainty of choice

At the investment stage, it is unknown which company the SPAC will acquire. This means that the investor is essentially investing “blindly”.

2) Sponsors’ interests

SPAC sponsors receive compensation (usually about 20% of the shares) even if the investment is not successful. This can create a conflict of interest.

3) Overstated expectations

Many SPACs overestimate the potential of their deals. As a result, shares often fell in price after the merger.

4) Increased regulations

In the USA, the Securities and Exchange Commission (SEC) began to monitor such deals more closely, demanding greater transparency, which slows the process.

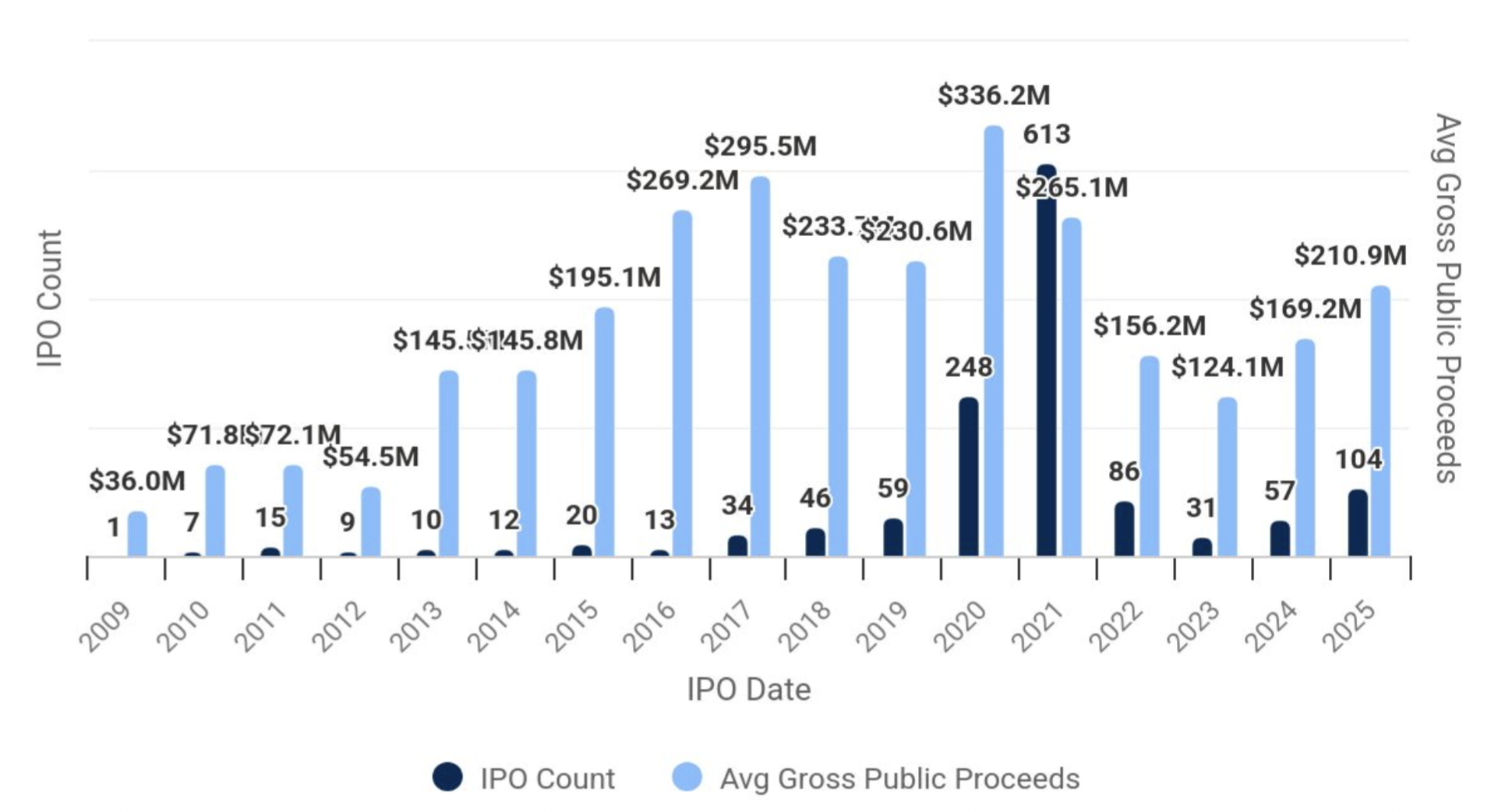

Since 2020, the number of new SPAC deals has been decreasing compared to the peak years. However, this instrument did not disappear. Thanks to tighter regulations, enhanced disclosures, and stricter projection rules, it has transformed. Now SPAC is less “speculative”

Source: https://www.spacinsider.com/data/stats

Is it worth investing in SPACs today?

SPAC remains an interesting but risky investment tool. For experienced investors, they can be a way to gain access to promising private companies at an early stage. However, such an investment may be too unpredictable.

Before investing in a SPAC, it is worth paying attention to:

the experience and reputation of the sponsors

the industry in which the acquisition is planned

the transparency of the terms and financial reports

the time remaining until the search for the target deal is completed

SPAC can be an attractive opportunity if the team has a clear strategy, experience, and a history of successful deals in the past.

Despite the decline in interest, experts do not predict a drastic decrease in SPACs due to new, more regulated forms.

It is expected that:

more professional and experienced teams of sponsors will remain on the market

the number of SPACs in niche sectors will grow - for example in green technology, biotechnology or AI

the emphasis and long-term strategy rather than rapid growth

Conclusion

To sum it up, SPAC is an investment tool that combines elements of venture capital and stock exchange mechanisms. Its popularity may fluctuate, but the idea itself - to provide private companies with fast access to the market - remains relevant.

For investors, SPACs are a chance to get involved in promising businesses at an early stage, but also a risk of losing their investment due to an unsuccessful deal. As with any investment, the key factors remain the quality of the team and the transparency of the process.