Introduction

Today known as the top financial center of the world, Wall Street has its early financial roots as a Dutch trading center, when it was part of the New Amsterdam. Wall Street, located in Manhattan, New York, spans just eight blocks from Broadway to South Street. Within this relatively short stretch lies the New York Stock Exchange (NYSE) along with a cluster of banks, financial firms, and major corporations.

However, Wall Street represents far more than its physical boundaries. It stands as a powerful emblem of American capitalism, encompassing everything from investment banking and hedge funds to securities trading and portfolio management. Often referred to as the lifeblood of the U.S. financial system, Wall Street’s influence is rooted in history, as some of the most prominent brokerages and investment banks established their headquarters there, drawn by proximity to the NYSE.

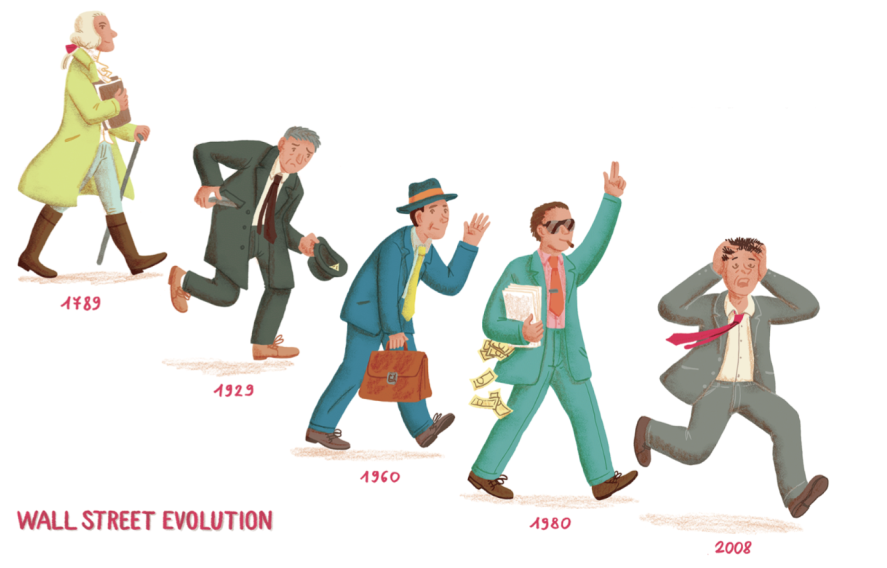

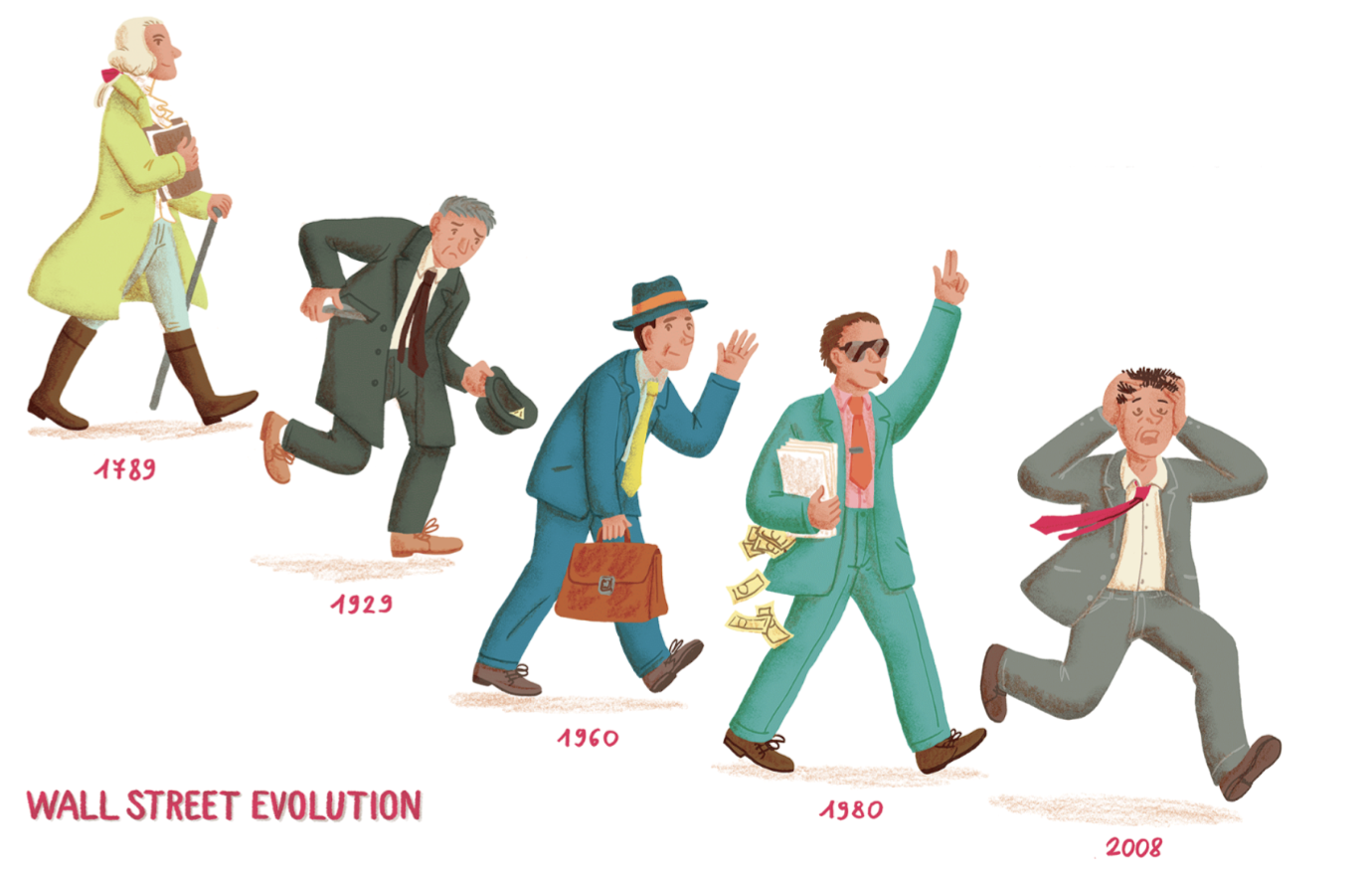

Source: www.vice.com/

Origins of the modern form

Wall Street's history is one of transformation and resilience. Originating as a defensive wall in the 17th century, it grew into a financial center with the signing of the Buttonwood Agreement in 1792. Over time, it faced significant challenges, including the 1929 stock market crash and Black Monday in 1987. These milestones played a pivotal role in cementing Wall Street's prominence in global finance.

Key advancements like the opening of the Erie Canal, the launch of the country’s first power plant on Pearl Street, and the introduction of the telegraph significantly boosted commerce in New York. At the same time, Wall Street financiers introduced groundbreaking innovations, such as Charles Dow’s stock tracking methods and the invention of the stock ticker, which streamlined operations and gave them a competitive edge over rivals in Philadelphia.

As the nation grew, Wall Street experienced a surge in activity, evolving into a central hub of commerce where brokers and merchants conducted transactions both outdoors and in local coffeehouses.

This lively environment drew a diverse array of individuals, including artisans, craftsmen, and other professionals eager to benefit from the thriving economy. Wall Street soon emerged as a beacon of opportunity and success, attracting ambitious people from across the country to pursue their aspirations in the rapidly expanding financial district. One of the important moments was also in 1817, when signatories of the Buttonwood Agreement established the New York Stock and Exchange Board, inspired by the Philadelphia Merchants Exchange. This institution would later evolve into what is now known as the New York Stock Exchange.

Rise of Industrialization and Economic Expansion

Wall Street solidified its role as the nation’s financial hub, bridging "Old World capital and New World ambition," as described by one historian. During this period, influential figures like J.P. Morgan established massive trusts, and John D. Rockefeller’s Standard Oil relocated its headquarters to New York City. Between 1860 and 1920, the U.S. economy shifted from agriculture to industry and ultimately to finance, yet New York retained its dominant position. According to historian Thomas Kessner, the city was second only to London as a global financial center.

In 1884, Charles Dow began monitoring stock performance by tracking the average prices of 11 companies, most of which were railroads, laying the foundation for modern stock indices.

In 1869, the New York Stock and Exchange Board consolidated with a rival entity known as The Open Board of Brokers. This merger played a pivotal role in establishing the NYSE as a central hub for financial trading. Membership was limited to a fixed number, a practice that continues today, albeit with periodic increases over time.

Wall Street and Financial Crises

The stock market crash of 1929 and the subsequent Great Depression prompted significant changes, introducing stricter government oversight and regulation of U.S. stock exchanges. Before the crash, trading operated with minimal regulation, but the crisis underscored the need for enhanced safeguards to protect investors and maintain market stability.

2008 – Following the collapse of several major investments, most notably the subprime mortgage sector, the stock market collapses into the Great Recession. Economists debate whether this financial and investment crisis had anything to do with Congress repealing a law designed to prevent financial and investment crises less than 10 years prior.

Wall Street in the modern era

The late 20th and early 21st centuries ushered in a transformative period for Wall Street, driven by advancements in technology. The introduction of computers and the internet reshaped financial markets, paving the way for the dominance of electronic trading.

In the modern era, Wall Street operates as a sophisticated network of banks, investment firms, and traders leveraging state-of-the-art technology to execute transactions with unprecedented speed and precision. This rapid evolution underscores the dynamic and continually advancing nature of the financial industry.