This article will discuss fundamental concepts that will help you understand the potential risks of trading stocks on the US stock market. Without understanding these concepts, a trader is guaranteed to lose his trading deposit sooner or later.

Next, we will explore the terms and concepts in more detail to better understand the specifics of trading on the US stock market.

Buying Power

When you trade through Fondexx, you trade through a Proprietary Trading Company. The company, at its sole discretion, provides you with access to certain funds to manage, to execute transactions in a Managed Account and with DMA (Direct market access) to the market on which you can make trading operations.

When opening a trading account, a trader is provided with Leverage. By default, the leverage is 1:30 for trading on the Main trading session. Leverage forms the Buying Power, which makes it possible to trade stocks.

Having only $1000 on your trading balance and 1:30 leverage, a trader will have Buying Power: $30,000 and direct access to trading stocks on the US stock market.

When using leverage, you should always keep in mind that you can theoretically lose more money than your trading deposit. Theoretically, having $1000 on a trading account, leverage of 1:30 and Buying Power: $30,000, you can lose all $30,000 or even more (if, for example, you trade in Short).

Limited and unlimited risks

When trading stocks on the US stock market, a trader can have limited and unlimited risks, depending on the direction of trading. Let's see how it looks like in practice.

When trading Long, the risks are limited.

Example:

Trading deposit: $1000

Leverage: 1:30

Buying Power: 1000*30 = $30,000

Let's assume that we use our full Buying Power to open a Long position on the notional company XYZ. The cost of one share of XYZ: $30, using all the Buying Power we can buy a maximum of 1000 shares.

Max Pos Qty = Max Buying Power/Stock price = 30000/30 = 1000 shares

Where:

Max Pos Qty - the maximum number of shares in the position

Max Buying Power - maximum buying power

Stock price - the value of shares

The stock price of XYZ company can fall to a maximum of: $0.00, which means that the maximum risk on the trading account will be $30,000. That is, when trading Long, the risk is limited by the maximum Buying Power of the trading account.

When trading in Short, the risks are unlimited.

Example:

Trading deposit: $1000

Leverage: 1:30

Buying Power: 1000*30 = $30,000

Let's assume that we use our full Buying Power to open a Short position on the notional company XYZ. The cost of one share of XYZ: $30, using all the Buying Power we can open a Short position for a maximum of 1000 shares.

Max Pos Qty = Max Buying Power/Stock price = 30000/30 = -1000 shares

The price of XYZ stock can grow infinitely (up to $50, $100, $1000, etc.), which means that the maximum risk on a trading account is unlimited. If today a trader opened a Short position on 1000 shares of XYZ at $30, and tomorrow the stock price will rise to $100, the trading result will be:

PL = (Pos Avr Prc - Last Prc)*Qty= (30-100)*1000 = -$70,0000

Where:

PL - Profit/Loss: trading result

Pos Avr Prc - average price of the position

Last Prc - the current price of XYZ shares

Qty - the number of shares

Thus, the trader lost $40,000 more money than he used to open the Short position.

Of course, when opening a real account, a trader will not be allowed to use all the Buying Power in one position, especially if it is a Short. There are a number of restrictions, in the form of setting specialized technical account/risk parameters, which prevent potential losses exceeding the trader's trading deposit.

Let us consider these parameters in detail below.

Trading account and risk parameters

There are the following basic account parameters and risks. They are universal for all trading accounts.

Day BP - Buying Power for the Main trading session

Night BP - Buying Power for trading on the Pre/Post market

BP per Position - Buying Power

Max Pos/Order Qty - the maximum number of shares in a position/order

Max Loss - maximum risk per day

The account parameters and risks are set by default when opening a trading account:

Day BP - non-fixed, depends on the balance, leverage 1:30

Night BP - zero value

BP per Position - 20% of Day BP

Max Pos/Order Qty - 1000 shares

Max Loss - $100

In addition to account parameters and risk, there are other control mechanisms to prevent losses. There are also very important terms/concepts that you need to understand when trading on a real trading account. We will consider everything in more detail later in the article.

Overnight, Pre/Post-Market trading

Below, we will consider in detail what trading periods exist on the US stock market.

Pre-Market - from 4:00 a.m. to 9:30 a.m. in New York

The main trading session - from 9:30 a.m. to 4:00 p.m. in New York

Post-Market - from 4:00 p.m. to 8:00 p.m. New York time

Overnight - moving a position/positions through the night, from 8:00 p.m. New York time of the current day to 4:00 a.m. New York time of the next day

Each trading period has its own rules and restrictions.

Working of orders

All types of orders can be used in the main trading session:

- Market

- Limit

- Stop

- Stop-Limit

Only the following order types can be used in the Pre/Post Market:

- Limit

- Stop-Limit

Leverage

During the main trading session, you can use full leverage (1:30)

On the Pre/Post Market, you can use a maximum leverage of 1:2 - 1:4

Restrictions on Overnight, Pre/Post Market trading

Overnight, Pre/Post Market trading is prohibited by default (except for Invest or Cash accounts).

If you want to trade on the Pre/Post Market, you need to send a request.

Similarly, if you want to leave positions on Overnight, you need to send a request to technical support (telegram: @fndxsupport) or telegram chat (telegram: @fndxaccounts) indicating the direction of trade, ticker and quantity. If you do not notify us of your plans, the risk manager has the right to close the positions and you will be penalized in accordance with the contract.

Overnight Leverage (for Long positions) is from 1:2 to 1:4.

Overnight Short positions must be agreed upon in advance.

What is important to know and understand about trading on the Pre/Post-Market:

Max Loss does not work on the Pre/Post-Market, a trader should carefully monitor his/her risk balance

Market and Stop-market orders do not work on Pre/Post-Market. Only Limit and Stop-Limit orders work

On the Post-Market, all Limit and Stop-Limit orders must be sent via ECN: ARCA

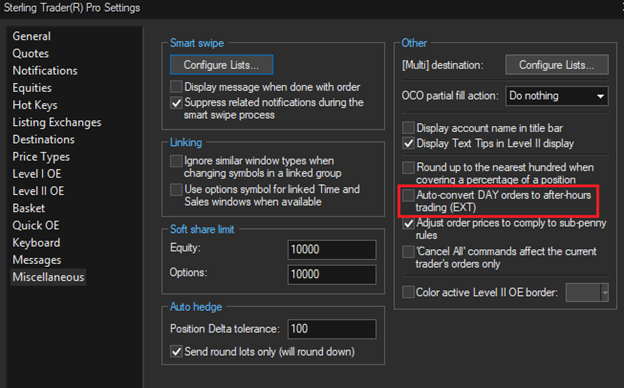

For the Sterling Pro platform, to send Limit orders to the Post-Market, you should use TIF: DAY. Also, be sure to disable the TIF auto-conversion function. Go to the main window -> View -> Settings -> Miscellaneous -> uncheck Auto-convert DAY orders to after-hours trading (EXT):

Image

If you plan to trade on the Post-Market, you need to send a request to the technical support or risk manager in advance

What is a risk balance (how is it calculated)?

Risk Balance - is the maximum balance that a trader can lose on his/her trading account. A trader must control his/her risk balance and prevent it from becoming negative.

If the risk balance becomes negative, the trader is obliged to reimburse the debt in accordance with the contract.

How the risk balance is calculated

For RT/Alpha trading platforms

Risk Balance = Current Balance

Where:

Current Balance is the current balance displayed inside the trading platform

For Sterling Pro/Takion/DAS trading platforms

Risk Balance = Balance at the beginning of the trading day - Platform/Quotes charges

Where:

Balance at the beginning of the trading day - the balance at the beginning of the trading day (displayed in the Personal Cabinet - My accounts - your trading account)

Platform/Quotes charges - charges for the platform and quotes, which will be charged on the last trading day of the month

Example:

A trader opened a Sterling Pro trading account on 01/01/24 with a deposit of $1500 and enabled the following quotes (Market Data Feed): NYSE, AMEX, NSDQ L1.

The cost of the Sterling Pro platform is $215 per month.

The cost of NYSE, AMEX, NSDQ L1 quotes is $133.07 per month.

On 01/31/24, the trader's trading account will be charged for the Platform and Market Data Fees: 215+137.07=348.07$

Accordingly, the risk balance as of 01/01/24 will be calculated as follows:

Risk Balance = 1500-348.07=$1151.93

What is the minimum trading balance?

Minimum trading balance - is a balance that may result in the forced closure of all positions in a market without warning.

For RT/Alpha trading platforms

The minimum trading balance is $100. If the minimum trading balance is reached, all positions may be closed automatically, without warning.

For Sterling Pro/Takion/DAS trading platforms

The minimum trading balance is $300. When the minimum trading balance is reached, all positions may be closed automatically, without warning.

What is Max Loss and what are the modes of operation?

Max Loss - is the risk for the day. It works only during the main trading session (from 9:30 a.m. to 04:00 p.m.). Max Loss is the default setting: $100. To change the Max Loss settings, please contact the technical support service. You can set the risk per day (Max Loss). It should not exceed 20% of the deposit.

Modes of operation when Max Loss is reached on the account:

Autoclose - when the Max Loss is reached, all positions will be automatically closed at market prices.

Available in the following trading platforms - DAS/Alpha/RT

Close/cxl only - when the Max Loss is reached, the positions will not be closed, but there will be no possibility to open new positions until the end of the trading session. The option is available only to close old positions.

Available in the following trading platforms - Sterling Pro/Takion/DAS/Alpha/RT

What is a Margin Call?

A Margin Call - is a forced closing of positions by the market (automatically on the server side or manually by a risk manager, depending on the trading platform and the trading session period).

Automatic Margin Call exists only in the RT/Alpha Pro trading platforms and works only during the Main trading session. When the risk balance reaches $40, all positions are automatically closed at market prices.

When positions may be closed by force:

- When the minimum trading balance is reached

- When a trader hasn't approved approve a trade on Post-Market

- When a trader has not approved and holds Overnight Long or Short positions

- When the Night BP on the Post-Market is exceeded. Max Night BP = Risk Balance * Overnight Leverage (1:2 - 1:4), where:

Max Night BP - the maximum possible BP on the Pre/Post Market

Purchase of Locates

Locate - is a permission from the broker, which must be obtained (bought) before opening a Short position for HTB shares.

There are ETB (Easy to Borrow) and HTB (Hard to Borrow) shares. ETB stocks can be traded in Short, HTB stocks can be traded in Short only after purchasing Locates. You should also understand that the number of locates is limited.

In our trading platforms, in the Level II window, an indicator is displayed to indicate whether the stock is: ETB or HTB.

The ability to purchase locates is available in the following trading platforms: Sterling Pro/Takion/DAS/Alpha/RT.

What you need to understand and know*:

- You can buy locates in the amount of 100 and in multiples of 100 (200, 300, etc.)

- In the window for purchasing locates, the price per 1 locate is displayed. Accordingly, if you want to buy 100 locates, you need to multiply the price for 1 locate by 100.

- The fee is charged for each purchased locate (in Alpha/RT trading platforms, the fee is charged immediately after the purchase. In Sterling Pro/Takion/DAS trading platforms, the fee is charged after the end of trading sessions)

- Information about the withdrawal for the locates is displayed the next day in the Personal Cabinet in the section My accounts -> Select the required trading account -> Trading reports -> Summary by date -> HTB/Adj Net columns

- Purchased locates cannot be canceled/refunded. Therefore, before purchasing locates, you should be very careful not to buy locates for the amount exceeding your Risk Balance

Conclusion

There are a wide range of technical and trading concepts, without understanding of which, the risks of losing a trading deposit significantly increase. Instead, if you have an understanding of all the terms and concepts described in this article, it will not only help you to save your trading deposit, but also improve your technical and trading expertise.

We hope that the information in this article was beneficial.

Sincerely, Fondexx Risk Management Department.