What is a Long position?

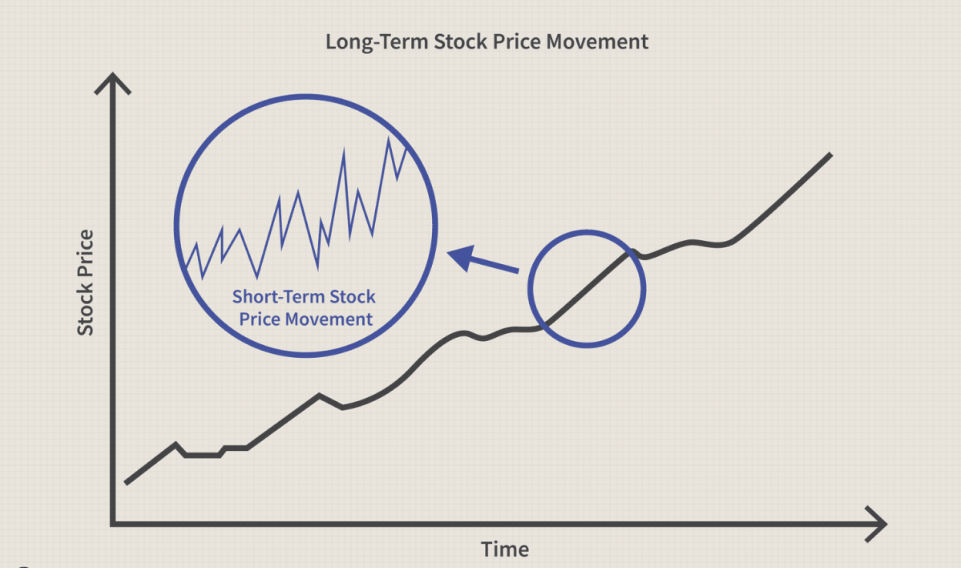

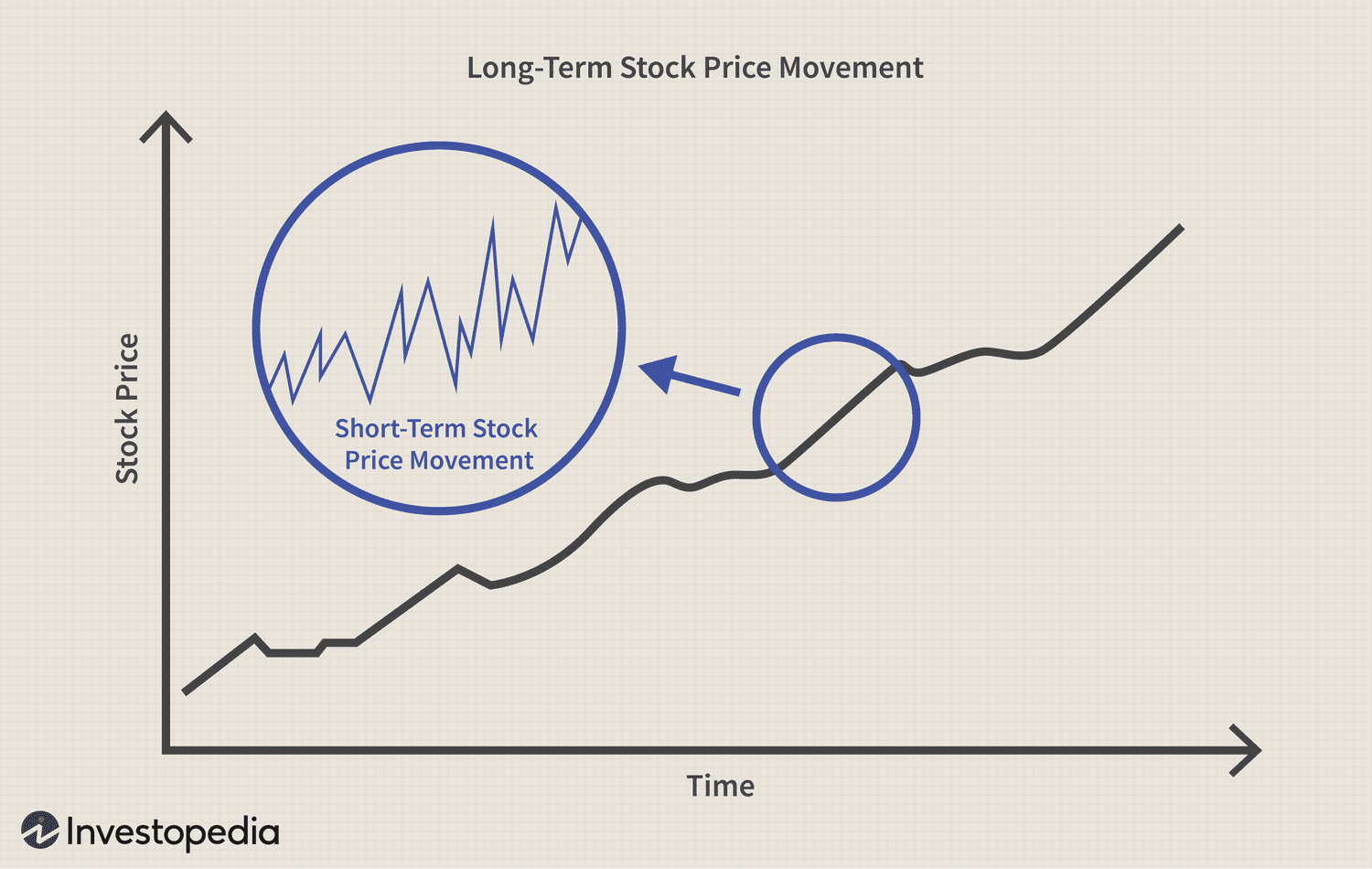

A long position is when an investor buys shares with the expectation that their value will increase over time. For example, let's say you buy 100 shares of XYZ company at $50 per share. You've done some preliminary analysis and assumed that the stock price will rise, so you hold it for a certain amount of time. If the stock price rises to $60 per share, you can sell it for a profit of $1,000 ($10 x 100 shares).

Potential advantages of a long position include the possibility of making a significant profit if the share price rises, as well as receiving dividends from the company. However, there are also certain risks. If the stock price goes down, you can lose money without having a risky strategy - holding a stock for too long can cause even more damage if its value drops significantly. But, besides the fact that the price of a share can rise, the price can also fall. How can a trader make money in this case? In this case, we will use the opposite position to the long position - a short position.

The main differences between long and short positions

The key difference between long and short positions lies in the investor's attitude to the value of the stock. A long position is a bullish strategy that assumes the price of a stock will rise, while a short position is a bearish strategy that assumes the price of a stock will fall. Long positions are generally considered less risky than short positions because an investor can profit from a rising stock price, while short positions can lead to unlimited losses if the stock price continues to rise.

How to open long positions?

There are several ways to take long positions on the stock market. One of them is to buy shares directly and thanks to prop companies such as Fondexx, this does not require significant capital but requires some knowledge. Another way is to use derivatives such as futures, options or contracts for difference (CFDs), which allow investors to speculate on stock price movements without actually owning them.

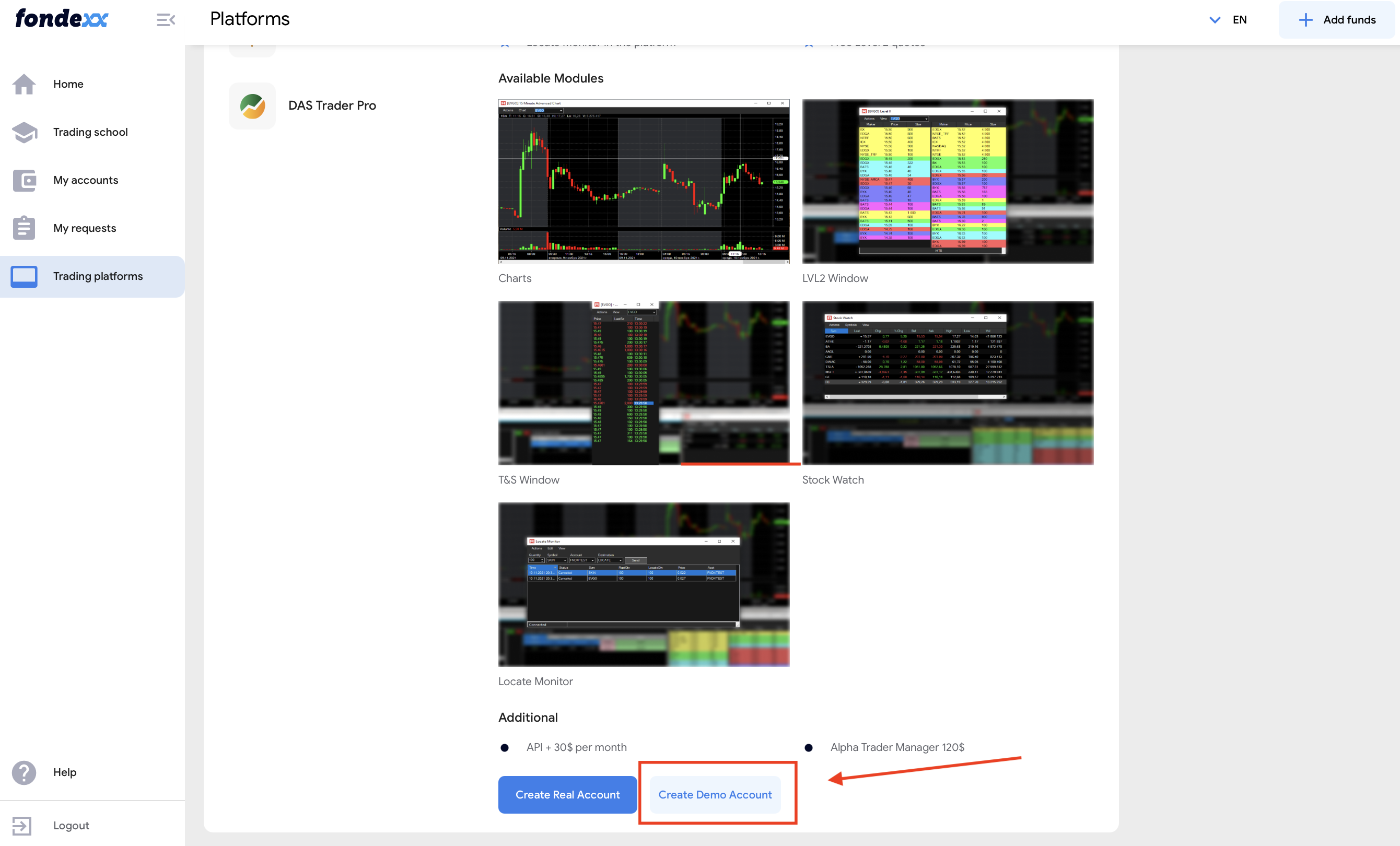

To understand what it looks like in practice, just visit our website and after a short registration in your Personal Account, using the RT Platform as an example, follow the simple steps in the following instructions:

1. Installing the platform, in our case RT (more detailed instructions from our YouTube channel)

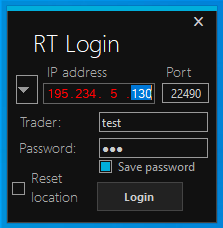

2. Authorization in the RT platform using data from the Personal Account

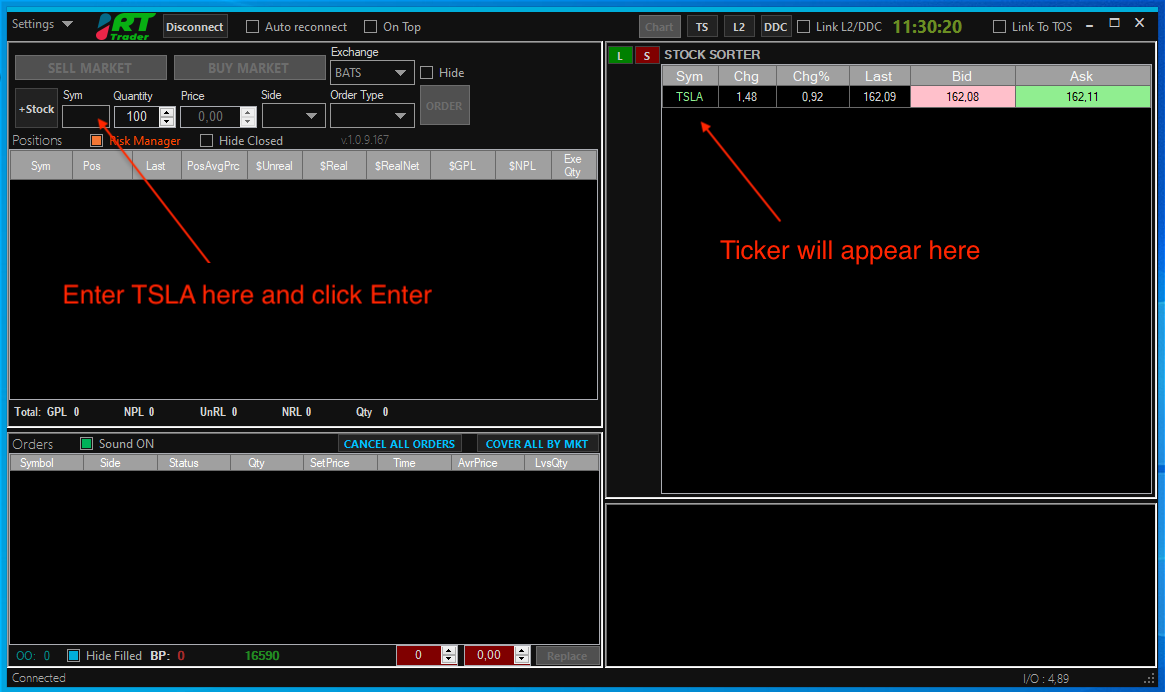

3. Adding TSLA stock by ticker to the watchlist

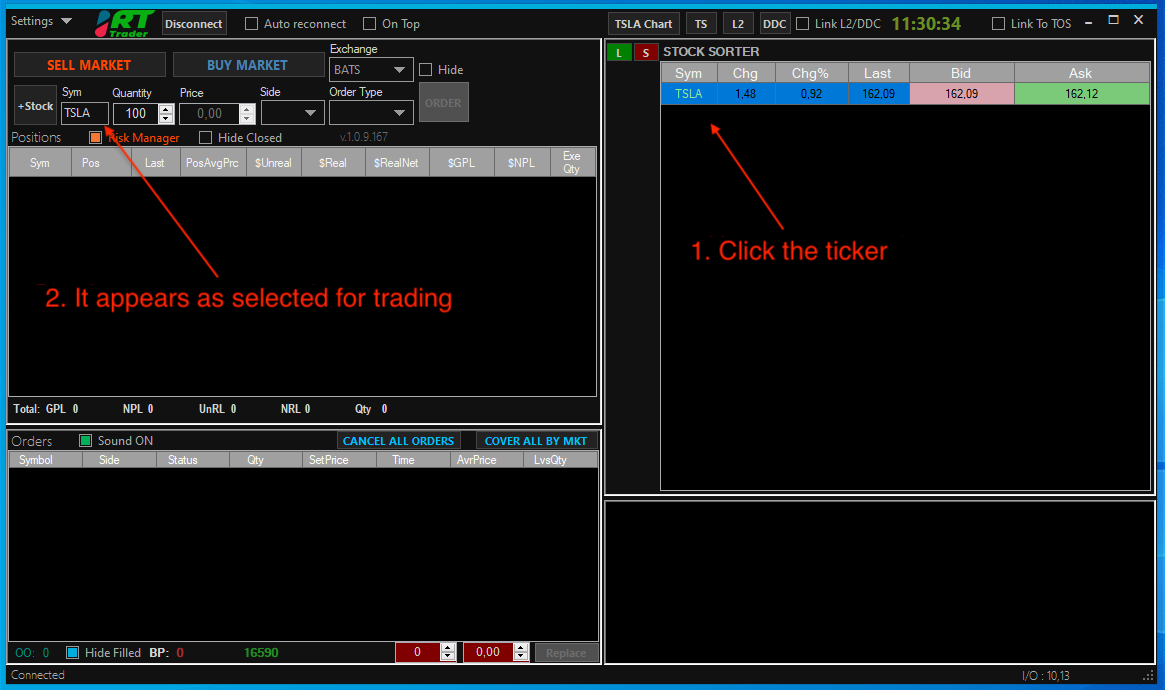

4. Click on the Ticker in the watchlist to select a stock to trade.

5. Change the number of shares to 200.

6. We don't care which order to execute the long, as we are learning, so - Click “Buy Market”

That's it, we can congratulate you - you have made your first long trade.

Was it difficult? - Technically, not at all.

What should I consider when opening and closing positions on a live account?

There is something that most brokers do not always warn you about - the cost of opening such a position. For every 100 shares you buy and sell, you pay a commission to the broker. And you also have to pay a certain cost for using the platform. So, at this very moment, most brokers are preparing a trap for you, telling you that the cost of the platform is zero, and the cost of the commission is diluted to a few cents per share to make it seem cheap.

For example, a bad broker tells you: “Your platform cost is 0, commission is 4 cents per share, go ahead and trade!”

It doesn't seem like much, right? But do the math on 10,000 shares! And this is a very small volume for a trader - so, in terms of money, you will pay $400 for a month of trading with such a broker!

Let's take Fondexx as an example of a good broker. With us, you will pay $40 for the cheapest platform and $77 commission for the same 10,000 shares of volume. So be careful - each of your Long or Short has a cost regardless of whether you make a profit or a loss!

But the question remains, why did we choose a long position rather than a short at this point in time?

Because we were learning and we did not have the task of identifying the trend and making a profit. We only wanted to execute the trade technically, because one of the main keys to successful trading is the ability to use the software 100%. And only then, the ability to analyze the market.

In order to minimize risk and maximize profit when opening long or short positions, it is important to conduct thorough research and analysis, set stop-loss orders to limit potential losses, and diversify your portfolio to spread risk. In order to learn how to determine the direction of trades, you need to start gradually studying trading as a new science. And the best place to start is with the NYSE Initial Point course, which, in a convenient format of recorded video lessons at a time convenient for most users, can give you all the necessary basis for starting your trading career. However, if you find the online format more convenient, the NYSE PRO course will provide you with the full range of information, skills and knowledge that a professional trader needs to make money.

To summarize:

Long is an important concept in stock trading that every investor should understand. By opening a long position, an investor bets on the growth of a stock, while a short position bets on its decline. Both strategies have potential benefits and risks, and there are different ways to take long positions in the stock market, depending on the investor's goals and risk tolerance. As with any investment strategy, it is important to conduct thorough research and analysis before taking any positions and to consider factors such as market trends, industry developments, and company fundamentals.

If you are interested in learning more about long positions, but starting in a structured and in-depth manner, register on our website and our managers will be sure to advise you on how best to start in the world of trading.

Remember to always evaluate your investment goals and risk tolerance before making any investment decisions. With the right knowledge and strategy, and with the help of Fondexx, which will provide you with the best software at the most affordable prices, long and short positions will be best implemented by you on your way to achieving your financial goals.